What If Your Weekly Coffee Run Could Fund a Community Garden?

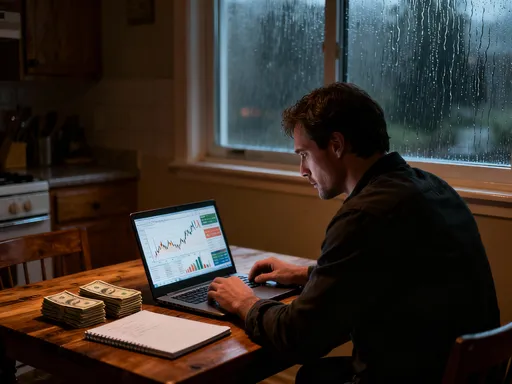

Ever feel like your small daily spends—coffee, snacks, ride-shares—vanish into thin air? What if tracking those little expenses could do more than save you money? Imagine turning that awareness into action, not just for your budget, but for your neighborhood. Together. This isn’t about cutting out joy—it’s about redirecting it. I remember the exact moment this clicked for me. It was a rainy Tuesday, and I was standing in line at my usual coffee spot, chatting with the barista like I do every morning. When I glanced at my bank app later that day, $35 had disappeared—just like that. Not on rent or groceries, but on lattes. And suddenly, I didn’t feel guilty. I felt curious. What if that money didn’t just leave my account, but went somewhere meaningful? What if it stayed in my community? That question sparked a journey—one that changed how I see money, connection, and what’s possible when we pay attention.

The Coffee Habit That Changed Everything

Let’s be honest—mornings are hard. For years, my routine was automatic: wake up, get the kids ready, rush out the door, and by the time I hit the sidewalk, I needed that cup of coffee like oxygen. It wasn’t just about the caffeine. It was the ritual, the five minutes of quiet before the day exploded into emails, school drop-offs, and endless to-do lists. That coffee wasn’t a luxury; it felt like survival. And I wasn’t alone. Most of us have these little daily comforts—something small that helps us cope, that feels like a tiny act of self-care in a world that never slows down.

Then one day, I downloaded a simple expense tracking app on a friend’s recommendation. No big plans, no budgeting overhaul—just curiosity. I started logging every purchase, even the $4 latte. After a week, the app showed me a number: $35. That’s how much I’d spent on coffee alone. At first, I flinched. But then something shifted. Instead of shame, I felt a quiet spark of possibility. What if I didn’t stop buying coffee—but paused to ask: what could this money do if I redirected it, just once? I shared that thought in a local parents’ Facebook group. I wrote, 'What if we all tracked our small daily spends for a month and used the savings to do something good for our neighborhood?' I didn’t expect much. But within hours, messages poured in. 'I spend that on parking.' 'I grab lunch out five times a week.' 'I didn’t even realize how much I was spending on streaming subscriptions.' That simple question didn’t just highlight spending—it revealed a shared desire to matter, to belong, to make a difference in a way that felt doable.

One woman, Sarah, replied: 'What if we actually did this? What if we saved that money and built something together?' That comment lit a fire. We weren’t just talking about cutting back—we were imagining building something. And it started with a coffee.

From Personal Tracking to Shared Purpose

We often think of budgeting as a solo act—a private battle between willpower and desire. But what if it could be something warmer, something connective? That’s exactly what happened when our online chat turned into a real-life experiment. We called ourselves the 'Change Makers,' a name that made us laugh at first but soon felt right. Twelve of us—moms, teachers, a nurse, a bookstore owner—committed to tracking every small expense for 30 days. Not to deprive ourselves, but to become aware. The goal wasn’t perfection. It was presence.

The app we used showed us patterns we’d never noticed. One woman realized she was spending $60 a month on bottled water. Another discovered she paid for three different meal-kit deliveries and barely used any of them. These weren’t failures—they were insights. And each insight became a choice: keep spending, or redirect. The magic wasn’t in giving things up. It was in deciding, together, what our money could do if we pooled it. We set a simple rule: every dollar saved from a small daily spend went into a shared fund. No pressure, no judgment. Just awareness and intention.

By the end of the month, we’d saved over $1,200. That number stunned us. It wasn’t from big sacrifices. It was from small, mindful shifts—skipping one coffee, packing lunch twice a week, canceling a forgotten subscription. And now we had a new question: what should we do with it? We gathered in a park one Saturday morning, kids playing nearby, coffee in hand (this time, brought from home). We talked about what our neighborhood needed. A safe place for kids to play? More green space? Better school supplies? The conversation was lively, full of care and vision. For the first time in years, I felt part of something real. Not a committee, not a fundraiser—but a community choosing to act, together.

How Technology Makes Group Accountability Possible

Here’s the truth: none of this would have worked without the right tools. We needed a way to track our progress, share updates, and stay honest—without turning it into a chore. That’s where technology stepped in, not as a cold calculator, but as a quiet helper. We used a mix of tools: some of us stuck with our favorite expense apps, others used a shared Google Sheet, and a few relied on Splitwise to log their savings. The key wasn’t the tool itself, but how it kept us connected.

Every Sunday night, someone would post a quick update in our group chat: 'Saved $12 this week by biking instead of ridesharing.' 'Skipped two takeout meals—$18 in the pot!' These weren’t bragging posts. They were quiet affirmations: 'I’m still here. I’m part of this.' The apps sent reminders, yes, but more than that—they created rhythm. A weekly check-in became something to look forward to, a small moment of pride. And when someone forgot to log a save, a gentle nudge from the app—or a playful message from a friend—brought them back in. No guilt, just grace.

What surprised me most was how much trust grew from this transparency. We weren’t hiding our slips or boasting about wins. We were just showing up, week after week. Technology made that possible by removing the friction. No one had to collect cash or keep paper records. The data lived in the cloud, visible to all. That openness didn’t feel invasive—it felt freeing. It was like saying, 'I’m not perfect, but I’m trying. And so are you.' That shared effort, supported by simple tools, became the backbone of our group. It wasn’t about the app. It was about what the app made possible: connection, clarity, and collective courage.

Real Stories: What Communities Have Built Together

Our group wasn’t the only one doing this. As we shared our story online, others reached out with their own. A group of teachers in Ohio tracked their lunch spending and raised enough to stock their school’s supply closet with notebooks, pencils, and backpacks for students in need. One woman told me, 'I used to feel guilty buying lunch out. Now I feel proud, because I know skipping one meal a week means a child has what they need.' That shift—from guilt to purpose—was everything.

In Portland, a neighborhood formed a 'No-Spend November' challenge. They saved over $2,000 and used it to fund a weekend park cleanup. They planted flowers, painted benches, and set up a Little Free Library filled with books in multiple languages. A mom there said, 'My kids helped paint the library. They walk past it every day and say, 'We did that.' That pride—it’s not just about the space. It’s about belonging.'

Another group in Austin started a tool-sharing library. They pooled savings from unused subscriptions and bought lawn mowers, drills, ladders, and gardening tools. Now neighbors borrow what they need instead of buying new. 'It’s not just about saving money,' one member said. 'It’s about knowing the person next door. We wave. We help. We matter to each other.'

These weren’t million-dollar projects. They were small, local, and deeply human. But the impact? Huge. People felt seen. They felt capable. They remembered that change doesn’t have to come from governments or billionaires—it can start with a group of neighbors who decide to pay attention. And every dollar saved wasn’t just a number. It was a vote for the kind of world they wanted to live in.

Starting Your Own Movement: A Step-by-Step Guide

You don’t need a big budget or a fancy plan to start something like this. You just need a spark—a question, a curiosity, a desire to do something that matters. Here’s how you can begin, in simple, doable steps.

First, find your people. It could be your neighbors, your school’s parent group, your coworkers, or even an online community you trust. Start small—five to ten people is perfect. Share your idea: 'What if we tracked our small daily spends for a month and used the savings to help our community?' Make it light, make it inviting. This isn’t a diet. It’s an experiment in meaning.

Next, pick your tracking method. If everyone’s comfortable with an app, go for it. YNAB, Mint, or even a shared spreadsheet works. The goal is visibility and ease. Choose one person to be the gentle keeper of the list—someone who sends a friendly weekly reminder but doesn’t judge. You’re not creating a boss. You’re creating a buddy.

Then, set your goal. It could be 30 days, 60 days, or even 90. Decide what counts as a 'small daily spend'—coffee, snacks, rideshares, subscriptions, takeout. Be clear, but flexible. The point isn’t to police each other. It’s to become aware.

Finally, decide what to do with the savings. Let the group vote. A community garden? School supplies? A local food bank? A bench in a park with a plaque that says, 'Built by neighbors'? Let it be something that matters to you. And don’t forget to celebrate. When you hit your first $100 saved, have a potluck. When the project is done, take a photo. These moments of joy are just as important as the savings.

Remember: you don’t have to be perfect. You don’t have to save the most. You just have to show up. And in showing up, you’re already changing things.

The Ripple Effect: How Saving Small Changes Lives

What surprised me most wasn’t the money we raised. It was the shifts I saw—in myself and in others. My daughter started asking, 'Mom, did you save your coffee money today?' Not to scold, but to connect. She wanted to be part of it. And in that moment, I realized I wasn’t just teaching her about money. I was teaching her about values. About choice. About how small actions, when shared, can grow into something beautiful.

One woman in our group told me she’d been feeling isolated since her kids started school. She didn’t know her neighbors. But through this challenge, she met people, had real conversations, even started a weekly coffee walk. 'I didn’t just save money,' she said. 'I found community.'

Another man, a widower, said this was the first thing he’d felt excited about in years. 'I used to spend without thinking. Now I think about what my money means. And I think about people. It’s not just about saving. It’s about connecting.'

That’s the deeper gift of this practice. It’s not just about the dollars. It’s about the awareness. When we track our spending, we’re not just managing money—we’re reflecting on our lives. Where does our energy go? Where does our care go? What do we truly value? The app doesn’t answer those questions. But it creates space for them. And in that space, growth happens. We become more intentional. More compassionate. More connected.

Building a Future Where Every Dollar Has Meaning

Here’s what I’ve learned: money isn’t just a number in an account. It’s a reflection of our time, our energy, our choices. And when we use it with intention—especially when we use it together—we do more than fund projects. We rebuild trust. We revive neighborhoods. We remind each other that we’re not alone.

Expense tracking apps are often sold as tools for control, for cutting back, for guilt. But they can be something else entirely. They can be tools of hope. Of connection. Of quiet revolution. Because every time you log a coffee, every time you pause and ask, 'What could this do?'—you’re not just saving money. You’re practicing mindfulness. You’re voting for a different kind of life.

And when you do it with others, that vote multiplies. That coffee run? It could fund a garden where kids pick tomatoes. That forgotten subscription? It could buy books for a classroom. That ride-share you skipped? It could help clean a park where families picnic. None of it is too small. None of it is meaningless.

Technology, at its best, doesn’t replace human connection. It amplifies it. It gives us the tools to see clearly, to act together, to build something real. And in a world that often feels fragmented, that’s a quiet miracle.

So the next time you’re about to tap your card for that latte, pause. Not to deny yourself joy—but to ask a better question. What if this moment could do more? What if your small choice, tracked with care, could grow into something beautiful—for you, for your family, for your community? Because it can. And it starts with a single, mindful click.