How I Built a Retirement That Lets Me Walk Away Early—And Sleep Well at Night

What if you could leave your 9-to-5 behind years before the norm—and actually feel safe doing it? I asked myself that question at 35, burned out and wondering if early retirement was just a fantasy. The truth? It’s possible, but not without a solid plan. The real game-changer wasn’t saving more money—it was how I spread it out. This is the story of how asset diversification became my safety net, and how it can give you the freedom to retire early without the constant fear of running out.

The Early Exit Dream: Why More People Are Chasing Financial Independence

For decades, retirement was framed as a finish line reached in one’s sixties—after 40 years of work, a gold watch, and a modest pension. But that model is quietly shifting. More individuals, especially those in their thirties and forties, are redefining retirement not as an age but as a state of financial independence. This means having enough sustainable income to cover living expenses without relying on a traditional job. It’s not about luxury yachts or constant travel, though those may be part of someone’s vision. For most, early retirement is about reclaiming time—time to care for aging parents, raise children without constant stress, or simply live at a pace that allows for presence rather than perpetual motion.

The push toward financial independence is driven by a combination of economic uncertainty and personal awareness. Many have witnessed parents or older siblings struggle with job insecurity late in life, or seen retirement accounts shrink during market downturns. Others have experienced burnout from high-pressure careers, realizing that health and well-being can’t be restored once lost. The pandemic further accelerated this shift, prompting widespread reflection on what truly matters. Suddenly, the idea of working until 65 or 70 no longer felt like a given—it felt like a risk, especially if health, job stability, or family needs could change overnight.

Yet, despite its growing appeal, early retirement is often misunderstood. Some assume it requires extreme frugality—living on rice and beans, driving a 20-year-old car, and never dining out. Others believe it demands a six-figure salary or a tech startup exit. In reality, financial independence is more about consistency than extremes. It’s built on steady saving, smart investing, and above all, a strategy that protects wealth as much as it grows it. The biggest misconception is that early retirement means stopping all income. Instead, it means transitioning from active income—trading time for money—to passive income, where assets work on your behalf.

This shift doesn’t happen by accident. It requires planning that goes beyond simply maxing out a 401(k). The central challenge is sustainability: how do you generate reliable income year after year, especially when you’re no longer contributing to savings? Inflation, market volatility, healthcare costs, and unexpected life events can all threaten even the most carefully built nest egg. That’s where the real work begins—not just in saving, but in structuring your assets so they continue to support you, no matter what the economy does. The solution isn’t one magic investment, but a system designed for resilience. And that system starts with diversification.

The Problem with Putting All Eggs in One Basket

Imagine spending 15 years carefully saving and investing, only to see your portfolio drop by 30% in a single year. That’s exactly what happened to many investors during the 2008 financial crisis and again in 2020 when the pandemic hit. For those nearing or already in early retirement, such declines aren’t just numbers on a screen—they can mean delaying retirement, cutting back on essential spending, or even returning to work. These outcomes often stem from a common but dangerous habit: concentrating too much wealth in a single asset class or investment type. While it might feel efficient to rely on one strong-performing account or strategy, it creates vulnerability that can undo years of disciplined saving.

One of the most frequent examples is overreliance on employer-sponsored retirement plans like 401(k)s, especially when heavily invested in company stock or a narrow set of funds. Some individuals, particularly in tech or finance, accumulate significant wealth in stock options or equity compensation. While this can generate impressive gains during bull markets, it also ties their financial fate to a single company and industry. If that company stumbles—or worse, collapses—their savings can evaporate quickly. The Enron scandal in the early 2000s remains a stark reminder of how quickly concentrated wealth can disappear when governance fails and markets turn.

Another common risk is focusing too heavily on stocks alone. Equities have historically delivered strong long-term returns, which makes them a cornerstone of most investment plans. However, they are also subject to significant short-term volatility. A portfolio made up entirely of stocks may grow quickly during economic expansions, but it can suffer deep losses during recessions. For someone living off their investments, a market downturn can force them to sell assets at a loss to cover living expenses—a double blow that reduces both principal and future earning potential. This is known as sequence-of-returns risk, and it’s one of the most serious threats to early retirees.

Inflation presents another hidden danger. Cash savings and low-yield bonds may feel safe, but they can lose purchasing power over time. If your portfolio isn’t generating returns that outpace inflation, you’re effectively losing money even if the account balance stays the same. For example, with an average inflation rate of 3%, the cost of living doubles roughly every 24 years. That means $50,000 in annual expenses today would require $100,000 in 24 years just to maintain the same standard of living. A portfolio that doesn’t account for this reality may appear sufficient at retirement but fall short within a decade.

Then there’s the issue of liquidity. Some investments, like real estate or private businesses, can generate strong returns but are difficult to convert into cash quickly. If an unexpected expense arises—a major home repair, a medical bill, or a family emergency—having all assets locked in illiquid forms can force difficult choices. Selling at an inopportune time, taking on debt, or disrupting long-term plans may become necessary. These scenarios highlight a crucial truth: saving aggressively is only half the battle. The other half is designing a portfolio that can withstand shocks, adapt to changing needs, and continue producing income without requiring constant oversight or market timing.

Asset Diversification Decoded: What It Really Means (And What It Doesn’t)

Diversification is often described as the only free lunch in investing, but it’s also one of the most misunderstood concepts. At its core, diversification means spreading investments across different asset classes, sectors, geographies, and income types to reduce risk. The goal isn’t to eliminate risk entirely—that’s impossible in any financial endeavor—but to minimize the impact of any single failure. When done correctly, a diversified portfolio can smooth out volatility, protect against market swings, and provide more consistent returns over time. Yet, many investors think they’re diversified when they’re not, often confusing variety with true risk distribution.

True diversification goes beyond owning multiple mutual funds or exchange-traded funds (ETFs). For instance, someone might hold five different stock funds, all focused on U.S. large-cap technology companies. While this appears varied, it’s still highly concentrated in one sector and region. If tech stocks decline due to regulation, innovation slowdowns, or economic shifts, all funds could fall together. Real diversification requires low correlation between assets—meaning when one goes down, others may stay flat or even rise. This balance is achieved by combining assets that respond differently to economic conditions.

A well-diversified portfolio typically includes a mix of equities, bonds, real estate, cash equivalents, and alternative assets. Equities offer growth potential over the long term and help combat inflation. Bonds provide stability and generate regular income, which can be especially valuable during market downturns. Real estate adds another layer of inflation protection and can produce rental income. Cash and short-term instruments ensure liquidity for emergencies and short-term needs. Together, these components create a more resilient financial structure.

Geographic diversification is equally important. Relying solely on domestic markets exposes investors to country-specific risks, such as political instability, regulatory changes, or economic recessions. By including international stocks and bonds, investors gain exposure to global growth and reduce dependence on any single economy. Similarly, sector diversification ensures that no single industry dominates the portfolio. Energy, healthcare, consumer goods, and financial services often perform differently under various economic conditions, so spreading investments across them helps balance risk.

It’s also essential to understand what diversification does not guarantee. It won’t prevent losses during broad market declines, nor will it deliver higher returns than a concentrated bet during a bull run. Its value lies in consistency and risk management, not in outperforming the market every year. Some investors fall into the trap of “diworsification”—owning so many assets that they dilute returns without meaningfully reducing risk. The key is thoughtful allocation, not sheer quantity. A simple, well-structured portfolio with three or four core components can be more effective than a complex one with dozens of overlapping holdings.

Finally, diversification is not a one-time decision. It requires ongoing monitoring and adjustment. As markets shift and personal circumstances change, the original balance can drift. Regular rebalancing—selling assets that have grown too large and buying those that have underperformed—helps maintain the intended risk level. This disciplined approach prevents emotional decisions during market extremes and keeps the portfolio aligned with long-term goals.

Building Your Diversified Portfolio: A Step-by-Step Framework

Creating a diversified portfolio isn’t about guessing the next hot stock or timing the market. It’s a deliberate process that begins with self-assessment and ends with disciplined execution. The first step is understanding your personal financial profile, which includes risk tolerance, time horizon, and income needs. Risk tolerance refers to how much volatility you can comfortably handle—both financially and emotionally. Some people can watch their portfolio drop 20% without panic, while others may feel compelled to sell at a loss. Knowing your threshold helps determine the right mix of growth and stability assets.

Time horizon is another critical factor. If you’re in your thirties and planning for retirement in 30 years, you can afford to take on more risk because you have time to recover from market downturns. But if you’re nearing early retirement, capital preservation becomes more important. Income needs also shape the strategy. Someone aiming to replace $60,000 in annual expenses will have different requirements than someone needing $40,000. These factors together inform your asset allocation—the percentage of your portfolio assigned to each major category.

A common starting point is the traditional 60/40 model: 60% in equities for growth, 40% in bonds for stability. This balance has historically provided solid returns with manageable risk. However, it’s not a one-size-fits-all solution. Some may adjust it to 70/30 for more growth potential, while others near retirement might shift to 50/50 or even 40/60 for greater protection. Real estate can be incorporated as a separate 10–15% allocation, either through direct ownership or real estate investment trusts (REITs). Cash and cash equivalents—such as high-yield savings accounts, money market funds, or short-term CDs—should cover 6–12 months of living expenses to handle emergencies without touching long-term investments.

Once the target allocation is set, the next step is selecting specific investments. For equities, low-cost index funds or ETFs that track broad markets—like the S&P 500 or total stock market—are often the most effective choice. They provide instant diversification and historically outperform most actively managed funds over time. International funds add global exposure. For bonds, a mix of government, municipal, and high-quality corporate bonds can balance yield and safety. Municipal bonds may offer tax advantages for those in higher tax brackets, while Treasury Inflation-Protected Securities (TIPS) help guard against rising prices.

Implementation should be gradual. Dollar-cost averaging—investing a fixed amount regularly over time—reduces the risk of entering the market at a peak. It also builds discipline and removes the pressure to time the market perfectly. As the portfolio grows, periodic rebalancing ensures it stays aligned with the original plan. For example, if stocks outperform and now make up 70% of a 60/40 portfolio, selling some equities and buying bonds restores balance. This practice enforces the principle of “buy low, sell high” without requiring market predictions.

Equally important is aligning the portfolio with withdrawal strategies. Early retirees often use the 4% rule as a guideline—spending no more than 4% of their portfolio annually, adjusted for inflation. While not foolproof, it provides a starting point for estimating sustainability. More flexible approaches, like adjusting withdrawals based on market performance, can further extend portfolio life. The key is designing a system where income needs are met without depleting principal too quickly, especially in the early years of retirement when sequence-of-returns risk is highest.

Income Streams That Work While You’re Not: Beyond the Stock Market

Retirement income doesn’t have to come solely from selling investments. In fact, relying only on portfolio withdrawals increases vulnerability to market timing and reduces longevity. A more resilient approach is to build multiple income streams that continue generating money without requiring daily work. These passive or semi-passive sources provide stability, reduce pressure on investment accounts, and create a financial cushion during downturns.

Rental properties are one of the most established forms of passive income. When managed well, real estate can deliver steady cash flow, long-term appreciation, and tax benefits. Depreciation, mortgage interest, and operating expenses can be deducted, reducing taxable income. However, real estate is not entirely passive—tenants, repairs, and vacancies require attention. Some investors choose property management companies to reduce hands-on involvement, though this cuts into profits. Location, market conditions, and financing terms all influence success, so thorough research is essential before buying.

Dividend-paying stocks and funds offer another reliable income source. Companies with a history of consistent or growing dividends—often in sectors like utilities, consumer staples, and healthcare—can provide quarterly payments that supplement retirement income. Dividend reinvestment during the accumulation phase boosts growth, while cash payouts in retirement support living expenses. While dividends aren’t guaranteed and can be cut during tough times, a diversified portfolio of high-quality dividend payers tends to be more stable than growth stocks.

Small businesses and side ventures can also contribute. An online course, a digital product, or a service-based business built over time can generate income with minimal ongoing effort. For example, someone with expertise in gardening, cooking, or home organization might create a subscription website or sell downloadable guides. These ventures often start as hobbies but evolve into meaningful revenue streams. The key is scalability and automation—designing systems that don’t depend on constant personal involvement.

Peer-to-peer lending, royalties from creative work, and annuities are additional options, each with trade-offs. Peer lending offers higher yields than savings accounts but carries credit risk. Royalties from books, music, or photography can provide long-term income if the work remains in demand. Annuities, particularly fixed or indexed types, guarantee income for life but often come with fees and complexity. The goal isn’t to pursue every option, but to select a few that align with skills, interests, and risk tolerance.

What ties these income streams together is redundancy. If one source declines—rents drop, dividends are cut, a digital product loses popularity—others can help fill the gap. This diversification of income, not just assets, is what creates true financial resilience. It allows retirees to maintain their lifestyle without panicking during market corrections or economic shifts. The result is not just financial security, but peace of mind—the knowledge that income continues even when you’re not actively working.

Risk Control: Safeguarding Your Future Without Overcomplicating It

Growing wealth is only half the financial journey. Protecting it is equally important, especially when you’re living off your savings. Risk control isn’t about avoiding all danger—it’s about preparing for the inevitable ups and downs of life and markets. The most effective strategies are often simple: maintaining an emergency fund, carrying appropriate insurance, optimizing taxes, and avoiding emotional decisions.

An emergency fund is the foundation of financial safety. It should cover 6–12 months of essential expenses in a liquid, accessible account. This buffer prevents the need to sell investments during market downturns or take on high-interest debt when unexpected costs arise. For early retirees, this fund acts as a shock absorber, allowing time to assess options without making rushed financial decisions.

Insurance plays a critical role. Health insurance is essential, especially before Medicare eligibility. Long-term care insurance can protect against the high cost of assisted living or nursing care, which can quickly deplete savings. Disability insurance, while more relevant before retirement, ensures income continuity if an injury or illness prevents work during the accumulation phase. Home, auto, and umbrella liability policies also guard against catastrophic losses.

Tax efficiency is another key component. Withdrawals from traditional retirement accounts are taxed as ordinary income, which can push retirees into higher tax brackets. Strategic planning—such as balancing withdrawals from taxable, tax-deferred, and tax-free accounts (like Roth IRAs)—can minimize the tax burden. Converting traditional IRA funds to a Roth over time, during low-income years, can also reduce future tax liability. These strategies don’t eliminate taxes but help manage them in a way that preserves more of your wealth.

Behavioral discipline is perhaps the hardest but most important aspect of risk control. Market swings trigger fear and greed, leading to poor decisions like panic selling or chasing hot investments. Sticking to a long-term plan, rebalancing regularly, and focusing on fundamentals rather than headlines can prevent costly mistakes. Automating investments and withdrawals adds another layer of consistency, reducing the temptation to intervene based on emotion.

Legal structures like trusts can also provide protection, especially for larger estates. They allow for controlled distribution of assets, reduce probate time, and offer privacy. However, they are not necessary for everyone and should be considered based on individual circumstances and estate goals.

The goal of risk control is not perfection but preparedness. You don’t need every tool, but you do need a few reliable ones. By combining liquidity, insurance, tax planning, and emotional discipline, you create a safety net that supports your diversified portfolio and allows you to retire with confidence.

Putting It All Together: My Real-Life Diversification Journey

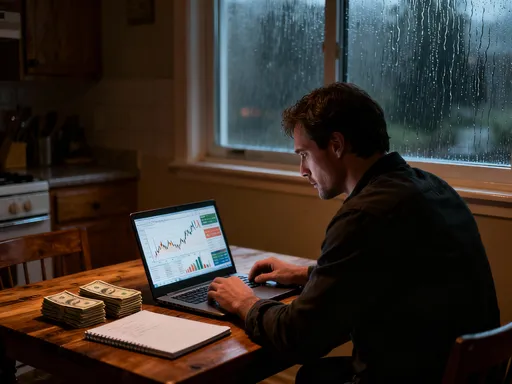

Looking back, my path to early retirement wasn’t marked by windfalls or risky bets. It was built on small, consistent choices—automating savings, learning about investing, and gradually shifting from a single-minded focus on accumulation to a broader strategy of sustainability. At first, like many, I believed the key was simply saving more. I maxed out retirement accounts, cut expenses, and tracked every dollar. But I realized something was missing when a market correction caused my portfolio to drop sharply. I wasn’t ready to retire yet, but the anxiety I felt made me question whether I ever would be.

That moment led me to study diversification not as a theoretical concept, but as a practical tool for peace of mind. I began by assessing my risk exposure: too much in U.S. stocks, too little in bonds, no real estate, and no passive income beyond investments. I didn’t make drastic changes overnight. Instead, I adjusted gradually—adding bond funds, opening a Roth IRA, and investing in a REIT for real estate exposure. I also started a small digital project, creating printable home organization tools. It earned little at first, but over time, it grew into a modest but reliable income stream.

I made mistakes along the way. I held onto an underperforming rental property too long, hoping it would improve. I panicked during a market dip and sold a small portion of stocks, only to buy back higher later. But each misstep taught me something—about patience, about process, and about the importance of systems over emotions. I learned to rebalance annually, to keep my emergency fund fully funded, and to view market volatility as a feature, not a flaw.

By my early forties, the combination of diversified assets and multiple income streams gave me the confidence to step away from full-time work. I didn’t stop all activity—I still consult occasionally and manage my projects—but I no longer depend on a paycheck. My portfolio is structured to generate income through dividends, interest, and gradual withdrawals, while my side ventures cover discretionary spending. Most importantly, I sleep well at night, knowing that no single event can derail my financial stability.

Early retirement isn’t about escaping work forever. It’s about having the freedom to choose how you spend your time. It’s about waking up without dread, making decisions based on values rather than necessity, and living with a sense of security that comes not from having infinite money, but from having a plan that works. Diversification didn’t just protect my savings—it gave me back my life. And that, more than any number in a bank account, is the true measure of financial success.