More than budgeting: How spending trackers helped me connect with like-minded friends

You know that moment when you’re trying to stick to a budget, but it feels so lonely? I was there—logging expenses, cutting back, and wondering if anyone else actually enjoyed saving. Then something unexpected happened. The app I used to track spending didn’t just show me where my money went—it led me to a group of people who cared about the same goals. We shared tips, celebrated small wins, and kept each other motivated. It wasn’t just about saving dollars. It became about building real connections. And honestly, that changed everything. What started as a quiet attempt to stop overspending turned into one of the most meaningful friendships of my life. I didn’t just gain control over my finances—I gained a community that made the journey feel lighter, warmer, and full of purpose.

The Lonely Struggle of Managing Money

Let’s be honest—budgeting can feel like a solo mission in a silent movie. You’re the only one tiptoeing past the coffee shop, whispering, “Not today,” while everyone else orders lattes without a second thought. I used to be that person—determined, yes, but also isolated. I’d open my notebook every night, scribble down my expenses, and sigh at the total. Another week, another few dollars gone on things I didn’t really need. I tried every method: envelopes, spreadsheets, sticky notes on the fridge. They helped, sure, but none of them answered the real question: Why does this feel so hard?

It wasn’t just about willpower. It was about silence. No one was cheering me on when I skipped dessert at dinner. No one noticed when I returned that sweater I’d worn once. I felt like I was failing at something that should be simple. And the more I focused on cutting back, the more I started to feel like I was missing out—on joy, on connection, on life. That’s when I realized the real issue wasn’t my spending. It was that I was trying to fix it all alone. I needed more than a budget. I needed someone to say, “I get it.” I just didn’t know where to find them.

Have you ever felt that way? Like you’re the only one who cares about saving, or meal planning, or saying no to things you can’t afford? You’re not. But when you’re stuck in your own head, it’s easy to forget that. I kept thinking, “If I were stronger, I wouldn’t need help.” But that mindset only made things worse. Strength isn’t about doing it all by yourself. Real strength is knowing when to reach out. And for me, that moment came when I finally let technology do more than just track numbers.

Discovering a Tool That Did More Than Track Numbers

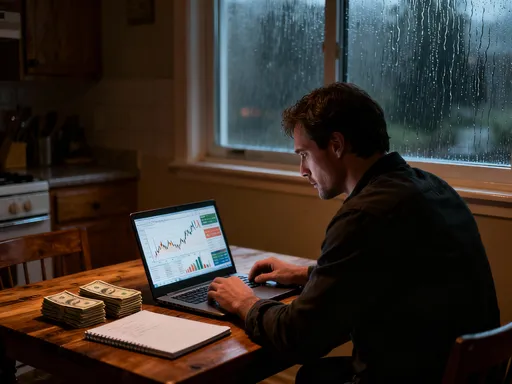

I downloaded a simple spending tracker app on a rainy Tuesday. I wasn’t expecting much—just another digital notebook to replace my messy spreadsheet. I hoped it would help me see patterns, maybe stop the surprise at the end of the month when my bank balance looked… concerning. The app was easy to use. It pulled in my transactions, sorted them into categories like groceries, dining, and shopping, and gave me a little progress bar for each budget. Cute, I thought. But would it really change anything?

Then I saw the notification: “Join a community of users working toward financial wellness.” I almost laughed. A community? About money? I clicked out of it at first. Talking about money with strangers felt… personal. Vulnerable. What if someone judged me for spending $6 on a smoothie? What if I judged them? But later that night, I opened the app again. Curiosity got the better of me. I scrolled through a few threads. One woman celebrated saving $30 by packing lunch all week. Another shared how she resisted buying a new handbag and put the money toward her emergency fund. These weren’t rich people giving advice. These were real people, just like me, trying to do better.

I took a breath and commented on a post: “I’ve been trying to cut back on takeout too. Any tips?” Within minutes, someone replied with a meal prep idea. Then another chimed in with a favorite budget grocery list. No judgment. No shame. Just support. That small interaction lit something up in me. For the first time, managing money didn’t feel like a punishment. It felt like a conversation. The app wasn’t just showing me my spending—it was helping me find my people. And that made all the difference.

From Data to Dialogue: How Tracking Sparked Conversations

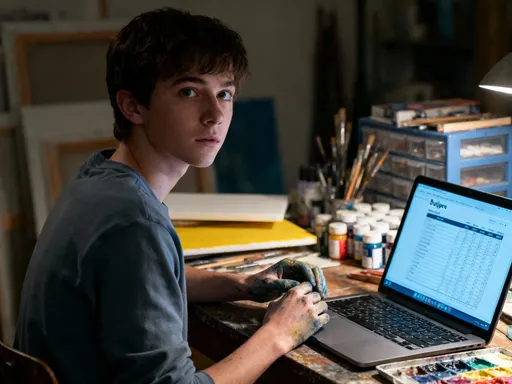

What surprised me most was how quickly numbers turned into stories. I used to think budgeting was about cold facts—how much you spent, where, and whether you stayed under. But in the app’s community, those numbers became entry points for real human connection. I read a post from a mom who saved $75 by canceling unused subscriptions. She didn’t just list the services—she shared how that money helped her buy books for her kids. That story stayed with me. It wasn’t about cutting costs. It was about redirecting value.

I started sharing too. I posted about my goal to save for a weekend getaway by cutting delivery fees. Someone responded, “I did that! Try batch-cooking on Sundays.” We started messaging. Then texting. Then meeting up for walks in the park. Our conversations weren’t just about money. We talked about parenting, work stress, even our favorite TV shows. But money was the thread that brought us together. It gave us a safe way to say, “I’m trying to make changes,” without sounding preachy or ashamed.

And here’s the thing—those conversations made the changes stick. When I was tempted to order pizza after a long day, I’d send a quick message: “Craving delivery. Help!” And someone would reply, “I’ve been there. How about leftovers with a movie?” It wasn’t about perfection. It was about having someone in your corner. Technology didn’t create the connection—but it made it easier to start. It gave us a shared language, a common starting point. Instead of feeling alone in my choices, I felt part of something bigger. And that made every small win feel worth celebrating.

Building a Circle Around Shared Goals

Our little group grew. The app had a feature that let users create private circles based on location and goals. I started one for women in my city who wanted to save without sacrificing joy. We called it “Smart & Supported.” At first, it was just five of us. We set up a monthly chat. Then someone suggested a potluck. “Bring a dish you made at home, and we’ll share budget-friendly recipes,” she said. I hesitated—meeting strangers? But I went. And it was wonderful.

We laughed, swapped stories, and tasted each other’s cooking. One woman made a delicious curry from pantry staples. Another brought a dessert using apples from her backyard tree. We talked about grocery hacks, seasonal sales, and how to say no to expensive birthday gifts without offending friends. It wasn’t a lecture. It was real life, shared. After that, we started meeting more often. A thrift-store challenge—spend under $20 and create a fun outfit. A “no-spend weekend” where we explored a nearby town using free trails and picnic lunches.

These weren’t just money-saving drills. They were social events. I met women I never would have crossed paths with otherwise. One introduced me to a community garden where I now grow tomatoes and herbs. Another told me about a free yoga class at the library. Our financial goals became gateways to new experiences—and real friendships. I wasn’t just saving money. I was building a life I loved, one small, intentional choice at a time. And having people to share it with made it all the more meaningful.

Growing Together: Personal Growth Through Group Support

As my circle grew, so did I. I used to avoid talking about money—especially with friends. I worried they’d think I was cheap, or worse, that they’d judge my past mistakes. But in this group, vulnerability wasn’t weakness. It was strength. When I admitted I once maxed out a credit card during a tough time, instead of judgment, I got nods and quiet “me too” messages. One woman said, “That was me five years ago. Look at us now.”

I started setting clearer boundaries. I learned to say no to events that didn’t fit my budget—without guilt. I even started planning low-cost gatherings, like game nights or nature walks. And when I almost broke my no-spend rule before a trip—eyeing a cute outfit at the mall—just typing out my struggle in the group chat helped. “Tempted, but saving for travel,” I wrote. Within minutes, three replies: “You’ve got this!” “Remember how good it felt last time?” “Wear your blue dress—it’s perfect!” That support kept me on track.

But it wasn’t just about money. It was about confidence. I was learning to trust myself. To communicate my values. To celebrate progress, not perfection. One member said something that stuck with me: “It’s not about being perfect. It’s about trying with people who care.” That shift in mindset changed everything. Saving wasn’t a chore. It wasn’t a punishment. It was a shared journey toward a calmer, more intentional life. And every step forward felt lighter because we were walking it together.

Technology as a Bridge, Not a Barrier

I’ll admit, I used to worry that technology was pulling us apart. That we were all staring at screens, losing real connection. But this experience taught me something different. The app didn’t replace face-to-face time. It made it possible. Without that first digital nudge—“Join a community”—I might never have reached out. Without the shared posts and private messages, we wouldn’t have found each other.

Technology handled the tracking, the organizing, the reminders. We handled the connection. The laughter. The encouragement. It lowered the barrier to saying, “Hey, I’m trying to do better—want to do it together?” Think about how hard that is to say in person. But online, it felt safe. Anonymous at first, then personal. Digital, then real. The app was the bridge. We were the ones who walked across it, hand in hand.

And once we met, the tech faded into the background. We still used the app to track spending, but we relied more on each other. We’d text before making a big purchase. Share wins in our group chat. Plan meetups using a shared calendar. The tools supported us, but the heart of it all was human. Technology didn’t steal our time—it gave us more of it. More time to connect. More time to grow. More time to live with purpose. It wasn’t the hero of the story. It was the quiet helper, making space for something beautiful to grow.

A Life That Feels Lighter—And Fuller

Today, I’m not just better with money. I’m better with life. My spending habits have improved, yes. I save more, plan ahead, and feel calmer about my finances. But the biggest change isn’t in my bank account. It’s in my heart. I feel seen. Supported. Part of something real. What started as a personal goal—spending less—became a shared journey. And that made all the difference.

We still use the app. But we rely more on each other. When someone shares a win—“I paid off my medical bill!”—we cheer. When someone slips—“I overspent on shoes, but I’m getting back on track”—we listen. No shame. No judgment. Just love and support. This isn’t just about saving dollars. It’s about investing in a life that feels lighter, richer, and full of real connection.

If you’re trying to manage your money and feeling alone, I want you to know—you don’t have to do it by yourself. Look for tools that do more than track. Look for communities. Start a conversation. Share your story. You might be surprised who’s walking the same path. Because sometimes, the best financial advice isn’t about budgets or spreadsheets. It’s about connection. It’s about finding your people. And when you do, you’ll realize that saving isn’t just about money. It’s about building a life you love—one small, shared step at a time.