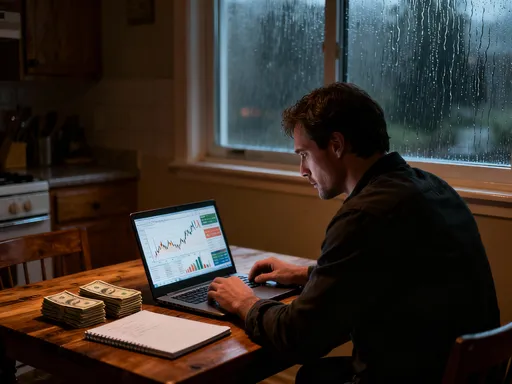

How I Retired Early by Riding Market Trends—No Luck Needed

What if retiring years ahead of schedule wasn’t about winning the lottery, but about reading the room—especially the financial one? I’m not a Wall Street insider or a tech millionaire. Just someone who paid attention, stayed flexible, and aligned my moves with real market shifts. It wasn’t magic—it was method. In this guide, I’ll walk you through how spotting trends, managing risk, and making consistent, smart choices can open the door to early financial freedom. This isn’t a fantasy of sudden wealth, but a practical roadmap built on patience, awareness, and disciplined action. The path to retiring early isn’t reserved for the privileged few. It’s accessible to anyone willing to understand the rhythm of the market, protect their capital, and let time do the heavy lifting.

The Wake-Up Call: Why I Started Looking Beyond Paychecks

For over a decade, I worked in a stable administrative role with a reliable paycheck, health benefits, and a modest employer-matched retirement plan. On paper, life was secure. But beneath the surface, anxiety grew. Each month, after rent, groceries, car payments, and student loan installments, there was little left. What savings I managed to set aside felt like drops in an ocean. A medical emergency, a job loss, or even a major appliance breakdown could unravel everything. The realization hit hard: stability without growth is still vulnerability.

What changed everything was paying attention—not to stock tips or get-rich-quick schemes, but to the world around me. I noticed how quickly delivery apps reshaped local restaurants, how remote work made certain cities less desirable while boosting others, and how energy prices influenced everything from grocery bills to travel costs. These weren’t isolated events; they were signals of deeper, structural shifts. I began to see that the economy wasn’t a distant machine—it was alive, responding to technology, behavior, and global forces. And if I could understand those movements, maybe I could position myself to benefit from them.

This sparked a fundamental shift in mindset. I stopped thinking of money solely as something to save and started seeing it as something to deploy. Saving alone would never get me to financial independence. It was like trying to fill a bathtub with the drain open. Investing wasn’t a luxury for the wealthy—it was a necessity for anyone who wanted control over their future. I realized that financial freedom doesn’t begin with a large bank account; it begins with awareness. Awareness that income can come from more than a job, that assets can grow while you sleep, and that small, consistent decisions compound into life-changing results. That awareness became the foundation of my journey toward early retirement.

Riding the Wave: How Market Trends Shape Real Opportunities

When people hear “market trends,” they often picture flashing charts, complex algorithms, or traders shouting on the floor of the New York Stock Exchange. But for the everyday investor, trends are much simpler: they are sustained shifts in behavior, technology, or policy that create long-term opportunities. The key isn’t predicting the future, but recognizing what’s already happening and positioning yourself to benefit from its momentum. This is not speculation—it’s strategic alignment.

Take the rise of remote work. Before the pandemic, it was a growing niche. Afterward, it became a permanent feature of the economy. Companies invested heavily in cloud infrastructure, cybersecurity, and collaboration tools. Those who noticed this shift early and invested in sectors like software as a service (SaaS) or digital payment platforms didn’t need to time the market perfectly—they just needed to be in the right place as demand grew. The same applies to sustainability. As consumer preferences shifted toward eco-friendly products and governments introduced incentives for clean energy, industries like solar technology and electric vehicles began a long-term expansion. These aren’t short-term fads; they are structural changes with years, even decades, of runway.

The real danger isn’t missing a trend—it’s reacting to noise. Market headlines scream about daily swings, geopolitical tensions, or inflation reports, often triggering emotional decisions. Selling during a downturn or buying into a hype-driven rally rarely ends well. Instead, I focused on what I call “signal over sentiment.” I asked: Is this change temporary or permanent? Is it driven by convenience or necessity? Does it solve a real problem at scale? For example, the demand for faster, more reliable internet isn’t going away—it’s only increasing. That makes investments in digital infrastructure far more resilient than chasing the latest meme stock.

By aligning my investments with these long-term forces, I reduced the need for constant intervention. I wasn’t trying to outsmart the market; I was trying to flow with it. This approach didn’t guarantee overnight riches, but it created a steady upward trajectory. Over time, the power of compounding turned modest gains into significant wealth. The lesson is clear: you don’t need luck to succeed—you need patience, observation, and the discipline to stay the course.

Building Your Financial Engine: Where to Park Your Money

Once I understood the importance of trends, the next step was building a portfolio that could grow steadily and reliably. I didn’t try to pick individual winners or time the market. Instead, I focused on creating a financial engine—automated, diversified, and designed to run with minimal daily oversight. The goal wasn’t to maximize short-term returns, but to ensure long-term, consistent growth.

My strategy centered on three core components. First, low-cost index funds. These funds track broad market indices like the S&P 500 and offer instant diversification across hundreds of companies. Historically, the S&P 500 has delivered average annual returns of about 7% to 10% after inflation over long periods. While past performance doesn’t guarantee future results, the underlying strength of the U.S. economy and its innovative capacity make this a reliable foundation. I allocated the majority of my portfolio to these funds because they minimize fees, reduce risk, and capture overall market growth.

Second, I included dividend-producing assets. These are companies with a history of paying regular dividends—cash distributions to shareholders. Reinvesting these dividends allows you to buy more shares over time, accelerating compounding. Utilities, consumer staples, and certain financial institutions often fall into this category. While their growth may be slower than tech stocks, their stability and income generation provide a buffer during volatile periods. In retirement, this income stream becomes especially valuable, helping to cover living expenses without selling shares.

Third, I reserved a smaller portion of my portfolio for selective growth opportunities aligned with long-term trends. This included exchange-traded funds (ETFs) focused on renewable energy, healthcare innovation, and digital infrastructure. These are more volatile than broad index funds, so I invested only what I could afford to hold for five to ten years. By limiting exposure, I maintained balance while still participating in high-potential areas.

Equally important was how I invested, not just what. I automated contributions to my retirement accounts—401(k), IRA, and taxable brokerage—so that money moved before I could spend it. I prioritized tax-advantaged accounts, where earnings grow tax-deferred or tax-free, significantly boosting long-term returns. And I stayed consistent. Whether the market was up or down, I kept investing the same amount each month—a strategy known as dollar-cost averaging. This smoothed out purchase prices and removed emotion from the process. Over time, time in the market proved far more valuable than timing the market.

The Risk Radar: Protecting Gains Without Panic

Many people think risk means losing money. But in investing, risk is better understood as the chance of not meeting your goals. A 20% market drop is painful, but it’s survivable if you’re prepared. The real danger comes from panic—selling low out of fear, locking in losses, and missing the recovery. That’s why risk management isn’t about avoiding volatility; it’s about building resilience so you can stay the course.

My approach to risk starts with diversification, but not just the basic kind. Yes, I spread investments across stocks, bonds, and real estate. But more importantly, I diversified across economic drivers. For example, I didn’t just own U.S. stocks—I included international funds to reduce dependence on one economy. I balanced growth-oriented assets with income-producing ones. And I made sure my portfolio wasn’t overly exposed to any single trend. If remote work slowed, other sectors like healthcare or infrastructure could still perform. This layered diversification protects against sector-specific shocks.

I also use trailing stops on certain holdings. A trailing stop is an automatic sell order that activates if a stock falls a set percentage below its peak—say, 15% or 20%. This isn’t about predicting crashes; it’s about setting rules in advance so emotions don’t take over. During the 2020 market drop, this strategy helped me exit some positions before losses deepened, preserving capital I could reinvest when prices stabilized. It’s not perfect, but it removes guesswork.

Rebalancing is another key tool. Every six months, I review my portfolio to ensure it hasn’t drifted too far from my target allocation. If one asset class has grown disproportionately—say, tech stocks now make up 40% of my portfolio instead of 20%—I sell some and reinvest in underweight areas. This forces me to “buy low, sell high” systematically, rather than emotionally.

Finally, I maintain a cash reserve—enough to cover one to two years of living expenses. This isn’t invested; it’s in a high-yield savings account. This buffer means I never have to sell investments during a downturn to cover bills. It’s my financial shock absorber. During uncertain times, this reserve gave me peace of mind. I didn’t need to react. I could wait, watch, and act when conditions improved. Protecting gains isn’t glamorous, but it’s essential. Because in the long run, avoiding major losses matters more than chasing big wins.

The Early Exit Blueprint: Redefining Retirement on Your Terms

Retiring early doesn’t mean stopping work forever. For me, it meant gaining the freedom to choose how, when, and where I spend my time. The first step was calculating my financial independence number—the amount of savings needed to cover my lifestyle indefinitely. I started by tracking my annual expenses: housing, food, insurance, travel, and personal spending. Then, I applied the 4% rule, a widely accepted guideline suggesting you can withdraw 4% of your portfolio annually, adjusted for inflation, without running out of money over a 30-year retirement.

But I didn’t apply this rule blindly. Market conditions in the 2020s—lower bond yields and higher valuations—made a strict 4% withdrawal riskier. So I adjusted. I used a more conservative 3.5% withdrawal rate, which meant saving a bit more. I also factored in healthcare costs, which can be significant before Medicare eligibility at age 65. I planned for inflation, assuming prices would rise about 2.5% per year on average. Using these numbers, I calculated that I needed roughly 25 times my annual expenses saved to retire comfortably.

Once I reached that goal, I didn’t quit immediately. I tested the lifestyle. I took a sabbatical, lived off my investment income, and tracked every expense. This trial period confirmed I could maintain my desired quality of life without depleting my savings. It also gave me confidence in my risk management strategies.

Early retirement doesn’t mean no income. I now earn money through part-time consulting, a small online course, and rental income from a property I own. These streams aren’t necessary for survival, but they extend the life of my portfolio and keep me engaged. I also embraced geographic arbitrage—moving to a region with a lower cost of living while maintaining income from outside sources. This simple move stretched my savings significantly, allowing me to live more comfortably on less.

The blueprint isn’t rigid. It’s flexible, adaptable, and designed for sustainability. It’s not about retiring at 40 or 50—it’s about gaining control. And that control comes from preparation, not luck.

Tools, Habits, and Small Wins That Add Up

Big results come from small, repeated actions. My journey wasn’t built on dramatic moves, but on daily and weekly habits that created momentum. The most powerful was automated investing. Every payday, a fixed amount went directly into my retirement and brokerage accounts. I never saw the money, so I never missed it. This habit ensured consistency, which is more important than the amount invested.

I also scheduled regular portfolio check-ins—quarterly, not daily. This prevented me from overreacting to short-term swings. During these reviews, I assessed performance, rebalanced if needed, and confirmed my strategy still aligned with long-term goals. I used free tools like personal finance dashboards and retirement calculators to track progress. These tools provided clarity, showing how small contributions grew over time. Watching the numbers rise, even slowly, kept me motivated during flat markets.

Mindful spending was another habit. I didn’t live frugally, but I spent intentionally. I asked: Does this purchase align with my values? Will it bring lasting satisfaction? Cutting unnecessary subscriptions, cooking at home more often, and delaying big purchases all freed up cash for investing. These weren’t sacrifices—they were choices that served a larger purpose.

Finally, I celebrated small wins. Paying off a credit card, hitting a savings milestone, or earning my first dividend payment—each was a signal of progress. These moments reinforced the habit loop: action, reward, repetition. Over time, the compounding effect applied not just to money, but to discipline and confidence. The journey became self-sustaining because I built systems, not willpower.

Staying Ahead: Why Trends Never Stop—and Neither Should You

Reaching early retirement wasn’t the end—it was a new beginning. Markets continue to evolve, and so must your strategy. Financial freedom isn’t a finish line; it’s a state of ongoing awareness and adaptation. Complacency is the real threat. The same forces that created opportunities in the past—technology, demographics, policy shifts—will keep shaping the future.

Today, I stay informed by reading credible financial publications, following long-term economic indicators, and listening to expert analyses. I don’t chase every new trend, but I remain curious. Artificial intelligence, energy transitions, aging populations—these are not passing fads. They represent structural changes that will influence markets for decades. I continue to adjust my portfolio gradually, ensuring it reflects these realities without overcommitting to unproven areas.

I also prioritize lifelong learning. I take online courses, attend webinars, and review my financial plan annually. This isn’t about becoming an expert—it’s about staying competent. The world changes, and so must your understanding. The discipline that got me to early retirement is the same discipline that keeps me secure now.

Financial freedom isn’t about having endless money. It’s about having choices. It’s about waking up each day knowing you’re not trapped by debt, fear, or a job you dislike. It’s about peace of mind, flexibility, and the ability to adapt. This journey didn’t require luck, insider knowledge, or extreme frugality. It required attention, consistency, and the courage to act. And if I could do it, so can you. The market isn’t your opponent—it’s your ally, if you know how to listen.