From Burnout to Breakthrough: How I Found Real Market Opportunities in My Career Shift

You’re not alone if you’ve ever felt stuck in a job that drains you, wondering how to make a move without losing stability. I’ve been there—trading time for money, until I realized the real game was outside my cubicle. This is how I navigated my career transition by spotting overlooked market opportunities, staying practical, and protecting myself from costly mistakes—no hype, just real moves that worked. It wasn’t about quitting impulsively or chasing a trendy side hustle. It was about observing patterns, understanding unmet needs, and building something sustainable with minimal risk. What began as personal frustration turned into a financial opportunity grounded in real-world demand.

The Breaking Point: Why I Knew It Was Time to Leave

For over a decade, I worked in corporate finance—a stable career with predictable paychecks and a clear hierarchy. On paper, everything looked fine. But beneath the surface, something was off. The long hours no longer felt productive; they felt like endurance tests. I found myself counting down the minutes until Friday, not because I loved the weekend, but because it meant escape from the emotional weight of the job. The work had become mechanical, and my sense of purpose had faded into the background.

The real turning point wasn’t a single event, but a slow accumulation of realizations. I noticed that even after promotions and raises, my satisfaction didn’t increase. In fact, the more responsibility I took on, the more disconnected I felt. I started asking hard questions: Was I building a meaningful career, or simply maintaining a lifestyle? Was I growing, or just surviving? These weren’t financial concerns—they were existential ones. Yet, they carried serious financial implications. Staying in a role that drained me wasn’t just bad for my well-being; it was a risk to my long-term earning potential.

What shifted my perspective was recognizing that my experience wasn’t unique. Friends, colleagues, and even acquaintances shared similar frustrations. The conversation always circled back to the same themes: lack of fulfillment, burnout, and a desire for more control over time and decisions. That collective unease wasn’t just background noise—it was a market signal. When large groups of people feel stuck, especially in high-skill professions, it creates space for new solutions. I began to see my dissatisfaction not as a personal failure, but as early insight into an emerging need.

Instead of rushing to leave, I paused. I treated my burnout not as a crisis, but as data. It revealed a gap: while companies offered career advancement, few supported meaningful transitions. There was no clear path for professionals who wanted to leave traditional roles without sacrificing financial security. That absence became my starting point. I didn’t need a revolutionary idea—just the willingness to address a problem that many were too overwhelmed to solve.

Spotting Gaps, Not Just Ideas: How to See Market Needs Clearly

Most people think opportunity comes from big, flashy ideas—apps, inventions, or viral trends. But in reality, the most reliable opportunities emerge from everyday frustrations. I started paying attention to the small inconveniences in my own life: the difficulty of finding trustworthy advice during career changes, the lack of structured guidance, the high cost of coaching, and the overwhelming amount of generic content that didn’t address real challenges. These weren’t just complaints—they were patterns pointing to unmet needs.

To sharpen my understanding, I began listening more intentionally. I joined online forums, participated in professional groups, and had honest conversations with people in transition. What I discovered was strikingly consistent. Many professionals felt isolated, unsure of their next steps, and skeptical of one-size-fits-all solutions. They weren’t looking for motivation—they wanted practical, step-by-step support. One recurring theme stood out: the need for clear, affordable financial and career guidance tailored to mid-career shifts. This wasn’t a niche interest; it was a widespread gap in the market.

The key insight was shifting from asking “What can I sell?” to asking “What do people actually need?” This reframing changed everything. Instead of forcing a product into the market, I focused on solving a real problem. I realized that credibility mattered more than creativity. People weren’t searching for another inspirational speaker—they wanted someone who had been through the process and could offer actionable insights. My background in finance wasn’t just a resume line; it was a foundation for building trust.

By focusing on overlooked pain points, I avoided the trap of chasing trends. I didn’t need to invent something entirely new—just deliver value where it was missing. This approach minimized guesswork and increased the odds of building something people would actually pay for. It also aligned with my values: helping others navigate transitions with clarity and confidence, without the pressure of unrealistic promises. The market opportunity wasn’t in disruption—it was in reliability, consistency, and real-world applicability.

Testing Without Risk: My Low-Cost Method to Validate Demand

One of the biggest mistakes people make is investing time and money into an idea before confirming that anyone wants it. I refused to fall into that trap. Instead of launching a full-scale business, I started with low-cost, low-risk experiments to test demand. My first move was creating simple digital resources—free guides, checklists, and short video clips—focused on common career transition challenges like financial planning, resume strategies, and mindset shifts.

I shared these materials in online communities where professionals discussed job changes, side hustles, and burnout. I didn’t promote them as products—just helpful tools from someone who had been through it. The response was immediate. Downloads increased steadily, and I began receiving direct messages from people asking for more detailed advice. Some even offered to pay for personalized sessions. This wasn’t just engagement—it was validation. People weren’t just consuming the content; they were acting on it.

The most telling moment came when one of my free guides was shared repeatedly in a large LinkedIn group. Within days, hundreds of people had downloaded it, and several reached out to ask about coaching. That was the signal I needed: there was real demand for structured, practical support. This lean validation process allowed me to confirm market interest without spending a single dollar on advertising or development. It also helped me refine my offerings based on feedback. I learned which topics resonated most—financial preparedness, confidence building, and strategic networking—and which ones needed more clarity.

By testing early and often, I avoided the costly mistake of building something nobody wanted. I also built an audience organically, which later became my first customer base. This phase taught me a crucial lesson: before you monetize, you must validate. And validation doesn’t require a business plan or a website—it just requires listening and responding to real needs. The data from these small experiments gave me the confidence to move forward, knowing I wasn’t betting on a dream, but on demonstrated demand.

Building a Safety Net: How I Managed Risk During the Transition

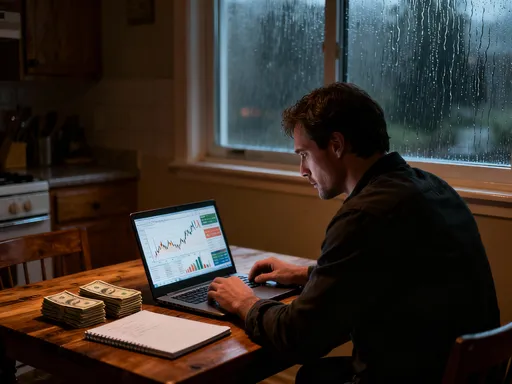

Leaving a stable job is never risk-free, but it doesn’t have to be reckless. My approach was to treat the transition like a financial project—planned, measured, and protected. I didn’t quit my job until I had built a safety net strong enough to sustain me through the uncertain early months. That meant calculating my monthly expenses, identifying non-essential costs I could cut, and determining exactly how long my savings would last if I earned nothing.

I treated my savings as a runway—like fuel for a plane. I knew I couldn’t fly indefinitely, but I could stay airborne long enough to gain altitude. I set a hard rule: no dipping into retirement funds or taking on debt. That discipline kept me grounded and forced me to focus on generating income early, even in small amounts. I started offering one-on-one consulting sessions and group workshops, pricing them accessibly but fairly. These services weren’t just a way to earn money—they were another form of market testing, giving me direct feedback from paying clients.

At the same time, I diversified my income streams. While one-on-one coaching provided steady cash flow, I also began developing digital products—recorded workshops, downloadable templates, and self-paced guides. These required more upfront work but could generate income passively over time. This mix of active and passive revenue reduced my dependence on any single source and increased financial stability. I also kept my day job for as long as possible, working on my side project during evenings and weekends. This allowed me to grow my business without sacrificing security.

Risk management wasn’t just about money—it was also about mindset. I set realistic expectations, knowing that growth would be gradual. I accepted that some months would be lean and that setbacks were part of the process. By planning for uncertainty, I reduced anxiety and avoided impulsive decisions. This structured approach gave me the freedom to experiment, learn, and adapt without the pressure of immediate success. Stability didn’t come from staying in my old job—it came from building a new foundation, piece by piece.

Turning Insight into Income: Monetizing Real Market Gaps

Once I had confirmed demand and built a safety net, I began turning insights into income. I designed offerings that directly addressed the pain points I had identified: financial uncertainty during transitions, lack of structure, and fear of failure. Instead of creating complex, expensive programs, I started with simple, high-value services. My first paid offering was a personalized transition roadmap—a step-by-step plan that included financial assessment, skill mapping, timeline planning, and confidence-building strategies.

Pricing was intentional. I set rates that were affordable for mid-career professionals but still reflected the value of the service. I avoided deep discounts or high-pressure sales tactics. Instead, I focused on transparency and results. Clients knew exactly what they would receive and why it mattered. This built trust and encouraged word-of-mouth referrals. As more people shared their success stories, demand grew organically. I didn’t need to chase customers—I just needed to deliver consistent value.

Over time, I expanded into group coaching programs and digital courses. These allowed me to help more people without scaling my time linearly. I used feedback from early clients to refine the content, ensuring it remained practical and actionable. For example, I added modules on managing family expectations, negotiating exit timelines, and building a personal brand—topics that emerged as common concerns. Every addition was driven by real user needs, not assumptions.

The monetization strategy wasn’t about maximizing profits quickly. It was about creating a sustainable business model that aligned with my values. I prioritized long-term relationships over short-term gains. This meant saying no to opportunities that didn’t fit, even if they promised fast money. It also meant investing in client success—because when they thrived, my reputation grew. The financial return followed naturally from the value delivered. Revenue increased steadily, not explosively, but in a way that felt stable and reliable.

Staying Grounded: Avoiding the Hype and Focusing on Sustainability

The online world is full of stories about overnight success—people who quit their jobs, launched a course, and made six figures in three months. While inspiring, these narratives can be misleading. They often leave out the years of preparation, the failures, and the financial buffers that made the leap possible. I made a conscious decision to ignore the hype and focus on sustainable growth. My goal wasn’t to go viral—it was to build something that lasted.

I tracked key metrics religiously: monthly revenue, client satisfaction scores, time invested, and conversion rates. This data helped me make informed decisions instead of emotional ones. When revenue dipped, I didn’t panic—I analyzed what changed and adjusted accordingly. Sometimes, that meant refining my messaging. Other times, it meant pausing new launches to focus on existing clients. I accepted that progress wasn’t linear and that seasons of slow growth were normal.

Sustainability also meant protecting my energy. I set clear work hours, took regular breaks, and prioritized rest. I learned that burnout wasn’t a badge of honor—it was a warning sign. By pacing myself, I maintained long-term momentum. I also stayed connected to my purpose. On tough days, I reminded myself why I started: to help others navigate transitions with less stress and more clarity. That sense of mission kept me going when motivation faded.

Success, I realized, wasn’t defined by income alone. It was about impact, stability, and peace of mind. I measured progress not just in dollars, but in client outcomes—people who found fulfilling roles, reduced their anxiety, and regained control of their lives. That kind of success couldn’t be faked or rushed. It had to be earned, one honest interaction at a time. By staying grounded, I built a business that reflected my values and supported the life I wanted.

Lessons That Stick: What I’d Do Differently Now

Looking back, the biggest lesson is that waiting for perfect conditions is a trap. I spent years thinking I needed more savings, a flawless plan, or guaranteed success before making a move. But the truth is, those conditions rarely exist. The right time is often *now*, even when it feels uncomfortable. If I could go back, I’d start experimenting earlier—testing ideas, sharing content, and talking to people—long before I felt ready. Action builds clarity, not the other way around.

I also underestimated the emotional toll of building something from scratch. It’s not just about time and money—it’s about resilience. There were moments of doubt, loneliness, and fear of failure. I wish I had prioritized support sooner—whether through mentors, peer groups, or therapy. Emotional strength is just as important as financial planning when navigating a career shift.

Another thing I’d do differently is embrace imperfection. I used to think every offering had to be polished and comprehensive. But in the early stages, simplicity wins. People don’t need perfection—they need help. A basic guide, a short call, or a simple template can make a real difference. Over time, you refine and expand. The key is to start, learn, and iterate.

Ultimately, my career shift wasn’t about escaping work—it was about finding work that mattered. The market opportunity wasn’t somewhere out there—it was hidden in my own experience. By paying attention to my struggles and listening to others, I found a path that was both financially viable and personally fulfilling. For anyone feeling stuck, I offer this: your frustration may be the first sign of a real opportunity. Don’t ignore it. Explore it. Test it. You don’t need a radical overhaul to begin. You just need a clear problem, a willingness to learn, and the courage to take the first step. The rest can be built, one practical move at a time.