How I Started Building Wealth Without Stress — A Beginner’s Journey with Real Investment Tools

What if you could start growing your money without needing a finance degree or taking big risks? I used to think investing was only for experts with suits and spreadsheets. But after feeling overwhelmed and stuck, I tested simple, real-world tools that actually fit my life. This is the honest story of how I began aligning my everyday choices with long-term financial goals — no hype, just practical steps that work. It wasn’t about making fast money or chasing trends. It was about creating a foundation that could grow quietly, steadily, and without constant worry. Over time, small decisions added up to real progress — and that made all the difference.

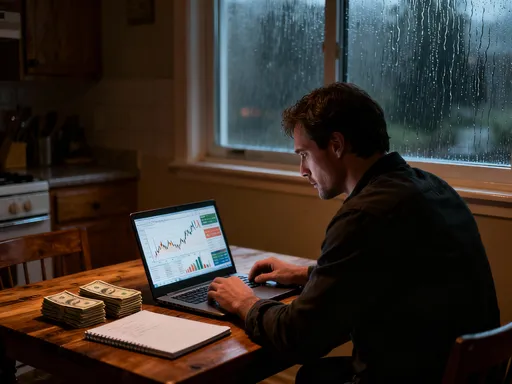

The Moment Everything Changed: Facing My Financial Reality

For years, I managed money the way many people do — reacting instead of planning. Paychecks arrived, bills got paid, and whatever was left over disappeared into daily expenses or occasional treats. There was no real strategy, just the hope that things would somehow work out. The idea of investing felt distant, like something for people with more time, knowledge, or money. I told myself I’d start “when I had more” or “when I understood it better.” But the truth was, I was avoiding the discomfort of not knowing.

That changed when I sat down to review my finances after a minor emergency — a car repair that shouldn’t have been a crisis but nearly emptied my checking account. As I looked at my balances, I realized how fragile my situation was. There was no emergency fund, no clear savings plan, and no sense of direction. I wasn’t in debt, but I wasn’t building anything either. The feeling wasn’t panic, but something quieter and more persistent: disappointment in myself. I wanted more security, more freedom, and more control — but I had been waiting for clarity instead of creating it.

That moment became a turning point. I decided to stop waiting for the perfect time and start learning with what I had. I didn’t need to become an expert overnight. I just needed to take one step. So I began by setting a simple goal: understand the basic tools available to someone like me — someone with a steady income, modest savings, and no financial background. I wasn’t looking for shortcuts or high-risk bets. I wanted reliable, real-world methods that could fit into my routine without adding stress. What I discovered was surprising: the tools weren’t as complicated as I thought, and many were designed specifically for beginners.

This shift in mindset — from avoidance to action — was the most important part of the journey. It wasn’t about having all the answers, but about being willing to ask questions and try. I started reading articles from trusted financial institutions, watching educational videos from regulated platforms, and exploring free resources offered by banks and investment firms. Slowly, the fog began to lift. I learned that building wealth isn’t about sudden breakthroughs; it’s about consistent choices that compound over time. And the first choice was simply deciding to begin.

What Are Investment Tools — And Why They’re Not Just for Experts

When I first heard the term “investment tools,” I imagined complex software used by Wall Street traders or expensive private accounts only available to the wealthy. But as I learned, investment tools are simply the practical resources that help people grow and manage money over time. They include accounts, platforms, strategies, and educational resources — all designed to make investing more accessible, structured, and effective. The key insight was that these tools aren’t reserved for experts. In fact, many are built with beginners in mind, offering guidance, automation, and simplicity to reduce the learning curve.

One of the first tools I explored was the brokerage account — a basic but powerful vehicle that allows individuals to buy and sell investments like stocks, bonds, and funds. What surprised me was how easy it was to open one. Reputable financial institutions offer online accounts with low or no minimum deposits, making entry accessible even with small amounts. These accounts often come with educational materials, market research, and customer support, helping users make informed decisions. More importantly, they provide direct access to the financial markets, which is where long-term growth happens. I realized that owning even a small piece of a company through a stock or fund meant I could benefit from its success over time.

Another game-changer was the rise of robo-advisors — digital platforms that use algorithms to build and manage investment portfolios based on a person’s goals, timeline, and risk tolerance. I was skeptical at first, wondering if a computer could really replace human advice. But after comparing options from well-established financial firms, I saw the value. Robo-advisors automate many of the complex decisions, like asset allocation and rebalancing, which are essential for long-term success but intimidating for newcomers. They also tend to have lower fees than traditional financial advisors, making them a cost-effective choice for those starting out. By answering a few simple questions, I could get a diversified portfolio set up in minutes — something that once seemed like it would take months of study.

Beyond accounts and platforms, I also discovered the importance of educational tools. Many financial institutions offer free courses, calculators, and planning guides that help users understand concepts like compound interest, risk tolerance, and retirement planning. These resources don’t promise riches, but they build confidence. I began using budgeting apps that linked to my bank accounts, helping me track spending and identify areas where I could save. Over time, these tools didn’t just provide information — they changed my behavior. I started seeing money not as something to be spent, but as a resource to be managed and grown. The takeaway was clear: investing isn’t about brilliance or luck. It’s about using the right tools consistently.

Matching Tools to Goals: From Dreaming Big to Planning Smart

One of the most valuable lessons I learned early on was that not all financial goals require the same approach. A common mistake is treating all savings the same way — putting every dollar into one account or investment without considering the purpose behind it. But just as different tasks require different tools in the kitchen, different financial goals require tailored strategies. The key is aligning each goal with the right tool based on time horizon, risk tolerance, and purpose.

Take the emergency fund, for example. This is money set aside for unexpected expenses — a medical bill, a home repair, or a job loss. Because it needs to be accessible and safe, the best tool is a high-yield savings account. These accounts are offered by many banks and credit unions and pay significantly more interest than traditional savings accounts, often with no risk to the principal. The Federal Deposit Insurance Corporation (FDIC) insures deposits up to $250,000, making it a secure option. I started by aiming to save three to six months’ worth of living expenses in this account. It wasn’t about earning high returns — it was about peace of mind. Knowing that money was there if I needed it reduced anxiety and allowed me to take thoughtful risks elsewhere.

For longer-term goals like buying a home or funding a child’s education, I turned to different tools. A five-year timeline meant I could accept a bit more risk for potentially higher returns. I explored low-cost index funds — investment vehicles that track broad market benchmarks like the S&P 500. These funds offer instant diversification, meaning I wasn’t betting on a single company but owning a slice of hundreds or thousands. Because they are passively managed, their fees are much lower than actively managed funds, which helps more of the returns stay in my account. I set up automatic contributions, so a fixed amount moved from my checking account to my investment account each month. This approach, known as dollar-cost averaging, reduces the impact of market fluctuations by spreading purchases over time.

When it came to retirement, the most powerful tool available was a tax-advantaged account like a 401(k) or IRA. These accounts offer significant benefits: contributions may be tax-deductible, and investment gains grow tax-free or tax-deferred until withdrawal. Many employers even match a portion of 401(k) contributions, which is essentially free money. I started by contributing enough to get the full employer match — a move financial experts consistently recommend. Over time, I increased my contributions as my income allowed. The combination of tax benefits, compound growth, and employer matching made this the cornerstone of my long-term strategy. By matching each goal with the right tool, I stopped feeling overwhelmed and started making progress — not because I had more money, but because I was using what I had more effectively.

Earning More: How the Right Tools Actually Work for You

One of the most empowering realizations in my journey was understanding that money can work for me — even when I’m not actively doing anything. This isn’t magic or speculation; it’s the result of compound returns, one of the most powerful forces in personal finance. Compound returns occur when investment earnings generate their own earnings over time. The longer the time horizon, the greater the effect. The tools I used — brokerage accounts, index funds, and retirement accounts — were designed to harness this principle, turning small, consistent actions into meaningful growth.

Let me break it down with a simple example. Suppose someone invests $200 per month with an average annual return of 7%. After 10 years, they would have contributed $24,000, but the account could be worth over $34,000 due to compounded growth. After 30 years, the total contributions would be $72,000, but the account could grow to over $240,000 — more than three times the amount invested. This isn’t a hypothetical scenario; it’s based on historical market performance and widely accepted financial modeling. The key isn’t timing the market or picking winning stocks — it’s staying invested and letting time do the heavy lifting.

Two mechanisms made this possible: reinvested dividends and dollar-cost averaging. Dividends are payments that some companies make to their shareholders, usually from profits. Instead of taking that money as cash, I chose to reinvest it — using it to buy more shares automatically. Over time, those additional shares also generated dividends, creating a snowball effect. Dollar-cost averaging, as mentioned earlier, involves investing a fixed amount regularly, regardless of market conditions. When prices are low, the fixed amount buys more shares; when prices are high, it buys fewer. This reduces the risk of investing a large sum at the wrong time and promotes disciplined, emotion-free investing.

The beauty of these tools is that they don’t require constant attention. Once set up, they operate in the background, quietly growing wealth while life goes on. I didn’t need to monitor the market every day or react to every headline. I simply stayed the course, trusted the process, and focused on consistency. Earning more wasn’t about getting rich quickly — it was about building a foundation that could grow steadily, year after year. And the most important ingredient? Time. The earlier you start, the more powerful the effect becomes.

Protecting What You Build: Risk Control Without Paralysis

When I first started investing, my biggest fear wasn’t losing money — it was making the wrong decision. I worried about picking the wrong fund, investing at the wrong time, or not understanding the risks. But as I learned, risk isn’t something to eliminate; it’s something to manage. The goal isn’t to avoid all risk — which would mean keeping all money in cash and losing value to inflation — but to control it through smart design. The tools I used included diversification, asset allocation, and emotional discipline, all of which helped me stay on track without constant stress.

Diversification means spreading investments across different asset classes — such as stocks, bonds, and real estate — and within those classes, across industries, companies, and regions. The idea is simple: if one investment performs poorly, others may perform well, balancing out the overall portfolio. I didn’t need to pick individual stocks to achieve this. Low-cost index funds and exchange-traded funds (ETFs) provided instant diversification by holding hundreds or thousands of securities. This reduced the impact of any single company’s failure and increased the stability of my portfolio over time.

Asset allocation — deciding how much to invest in each asset class — was another critical tool. Younger investors can typically afford more risk because they have time to recover from market downturns, so a higher allocation to stocks makes sense. As retirement approaches, a shift toward bonds and other income-producing assets can help preserve capital. I used robo-advisors and retirement planning tools to determine an appropriate mix based on my age, goals, and comfort level with risk. These tools rebalanced my portfolio automatically, selling assets that had grown too large and buying those that had fallen, keeping my strategy aligned with my plan.

Perhaps the most underrated risk control tool was emotional discipline. Market fluctuations are normal, but reacting to them — selling during a downturn or chasing hot trends — often leads to losses. I learned to view volatility as a feature, not a flaw, of long-term investing. By setting up automatic contributions and avoiding frequent checking of my account balance, I reduced the temptation to make impulsive decisions. I reminded myself that short-term noise doesn’t change long-term fundamentals. Over time, this mindset shift — from fear to focus — made the biggest difference. Risk wasn’t gone, but it was managed, and that made all the difference in staying the course.

Everyday Wins: Practical Habits That Multiply Results

While tools are essential, they only work when paired with consistent behavior. The most powerful investment strategy will fail if habits don’t support it. What I discovered was that small, repeatable actions — done regularly — had an outsized impact on my financial health. These weren’t dramatic sacrifices or extreme budgeting, but simple habits that reinforced discipline and awareness.

One of the most effective was reviewing my financial statements monthly. This wasn’t about micromanaging every dollar, but about staying informed. I checked my bank accounts, investment balances, and credit card statements to ensure everything matched my records. This helped me catch errors early, monitor progress toward goals, and adjust spending if needed. It also created a rhythm of accountability — a regular touchpoint to reflect on whether I was on track.

Another habit was adjusting my contributions as my income changed. When I received a raise or bonus, I didn’t increase my lifestyle spending automatically. Instead, I committed to directing at least half of the additional income toward savings or investments. This practice, known as “paying yourself first,” ensured that financial growth kept pace with income growth. Over time, these incremental increases added up significantly, without requiring major lifestyle changes.

I also became more intentional about avoiding lifestyle inflation — the tendency to spend more as income rises. It’s easy to justify a bigger house, a newer car, or more dining out when you earn more, but those choices can undermine long-term goals. I set boundaries for myself, like waiting 30 days before making large purchases or limiting discretionary spending to a fixed percentage of income. These rules weren’t restrictive — they were liberating. They gave me control and prevented small decisions from derailing bigger plans.

Finally, I made a habit of revisiting my financial goals annually. Life changes — marriages, children, career shifts — and financial plans should adapt too. By reviewing my goals each year, I could reassess my risk tolerance, update my timeline, and reallocate resources as needed. This ongoing process kept my strategy relevant and responsive. These habits didn’t require perfection, just consistency. And over time, they transformed access to tools into real, measurable results.

Starting Where You Are: No Perfect Time, Just Progress

Looking back, I realize that the biggest obstacle to building wealth wasn’t a lack of money, knowledge, or tools — it was the belief that I needed to have everything figured out before starting. I waited for certainty, for more savings, for the “right” moment. But that moment never came. What changed everything was the decision to begin anyway — to take one small step, then another. The journey wasn’t about perfection. It was about progress. And every expert investor I’ve read about or spoken to started exactly the same way: as a beginner with questions.

The tools I used — brokerage accounts, robo-advisors, high-yield savings, index funds, retirement accounts — are all accessible to anyone with a bank account and an internet connection. They don’t guarantee returns, but they provide structure, automation, and access to the mechanisms that drive long-term growth. What matters most isn’t the size of the first investment, but the act of starting. A $50 monthly contribution to a retirement account can grow into tens of thousands of dollars over decades. A high-yield savings account can turn modest deposits into a reliable safety net. The power lies in consistency, not scale.

Financial growth is not a sprint; it’s a marathon with no finish line. It’s about making choices today that support the life you want tomorrow. It’s about using tools not as shortcuts, but as partners in a long-term plan. And it’s about understanding that setbacks are normal — what matters is continuing forward. I still don’t have all the answers, and I still learn something new every year. But I have something better: confidence. Confidence that I’m building something real, one decision at a time. And if I can do it, so can you. The only thing you need to start is the willingness to begin — right where you are.