How I Scaled My Business Across Markets—The Investment Tools That Actually Worked

Expanding into new markets used to feel like gambling—until I found the right investment tools. As an entrepreneur, I’ve tested strategies that promised fast growth but delivered only stress. What changed? A shift from guessing to using proven financial instruments designed for real-world scalability. This is not theory—it’s what kept my business afloat during uncertain shifts and powered sustainable growth. Let me walk you through the tools that made the difference. For years, I believed that growth was about visibility, marketing, and product refinement. But when I attempted to scale beyond my home region, I realized the foundation of expansion wasn’t branding—it was financial architecture. Without the right financial scaffolding, even the most promising ventures can collapse under operational strain, currency volatility, or cash flow gaps. This journey wasn’t about luck. It was about learning which tools provide real leverage and which ones only promise it.

The Moment Everything Changed: Facing Market Expansion Head-On

There comes a point in every growing business when staying small feels like stagnation. For me, that moment arrived when demand from neighboring regions began to outpace what our local operations could handle. Customers were asking for faster delivery, broader product availability, and localized support. It was clear: expand or risk losing momentum. But my first attempts at scaling were far from graceful. I treated market entry like a marketing campaign—launch a website, run ads, open a warehouse, and expect sales to follow. What I didn’t anticipate was how quickly costs could spiral without corresponding revenue.

I invested heavily in logistics infrastructure, signed long-term leases for regional distribution centers, and hired local teams before fully understanding customer behavior or regulatory environments. Within six months, our burn rate had doubled, and profitability in the new markets remained elusive. The hardest lesson came during a quarterly review: we were growing in size but shrinking in financial resilience. That was the turning point. I realized that market expansion isn’t just about geography—it’s about financial strategy. Growth without financial control isn’t scaling; it’s overextension.

From that moment, I shifted my mindset. Instead of viewing expansion as a series of operational tasks, I began to see it as a financial engineering challenge. The goal was no longer just to enter new markets but to do so in a way that preserved capital, minimized downside risk, and allowed for course correction. This meant moving away from one-time capital injections and toward financial tools that adapted to real-time performance. It meant aligning investment with actual sales velocity, not projections. And most importantly, it meant building systems that could absorb shocks—because every new market brings surprises, and the best businesses aren’t the fastest, but the most adaptable.

Why Traditional Funding Falls Short in New Markets

At first, I turned to the most familiar sources of capital: bank loans and venture funding. Both seemed like logical choices. Banks offered debt at low interest rates, and venture capitalists brought not just money but industry connections. But as I deployed these funds across new regions, I began to see their limitations. Bank loans, while accessible, came with fixed repayment schedules. That rigidity became a problem when early sales in a new market lagged behind projections. Even with solid long-term potential, the pressure to generate immediate cash flow to service debt created operational stress. I found myself making short-term decisions—like discounting products or cutting staff—to meet financial obligations, undermining the very growth I was trying to achieve.

Venture capital presented a different set of challenges. While the influx of equity capital allowed for aggressive expansion, it also came with expectations of rapid returns. Investors wanted to see user growth, market share gains, and revenue spikes—often without accounting for the nuances of local markets. In one case, pressure to scale quickly led us to enter three countries simultaneously, despite insufficient market research. The result was diluted focus, higher customer acquisition costs, and a strain on management bandwidth. More importantly, giving up equity meant surrendering some control over strategic decisions—something I later regretted when asked to pivot away from sustainable, steady growth in favor of high-risk bets.

The deeper issue with both traditional models is that they assume a level of predictability that simply doesn’t exist in new markets. Consumer behavior, regulatory environments, supply chain reliability, and even payment habits can vary dramatically from one region to another. A funding model that works in a stable, mature market may fail in an emerging one. What I needed wasn’t more capital—it was more flexibility. I began searching for financial instruments that could adjust to real-world conditions, that wouldn’t penalize slow ramp-ups, and that aligned repayment or returns with actual business performance. That search led me to alternative investment tools that were designed not for ideal scenarios, but for the messy reality of global expansion.

Enter the Game-Changers: Real Investment Tools for Real Expansion

The real breakthrough came when I discovered financial instruments built for adaptability rather than rigidity. The first was revenue-based financing, a model where investors provide capital in exchange for a percentage of future revenue, up to a predetermined cap. Unlike a loan, there are no fixed monthly payments. Instead, repayments scale with sales—if revenue is low in a given month, the payment is smaller; when sales increase, so does the repayment. This was a game-changer for entering unpredictable markets. It allowed us to fund inventory and marketing without the pressure of fixed obligations, giving us breathing room during the critical early months.

Another essential tool was cross-border cash flow hedging. When we expanded into Europe, currency fluctuations between the dollar and the euro began to erode our margins. A sale that looked profitable on paper could lose money by the time funds were converted and transferred. To mitigate this, we partnered with a financial services provider that offered forward contracts and currency options. These instruments locked in exchange rates for future transactions, protecting us from sudden market swings. Over a 12-month period, this strategy saved us over 14% in potential losses due to volatility. It wasn’t about speculating on currency movements—it was about eliminating an unnecessary risk that had no relation to our core business performance.

We also adopted scalable equity structures, particularly for joint ventures in new regions. Instead of giving up large equity stakes upfront, we used earn-out agreements where ownership would transfer based on performance milestones. This aligned incentives with local partners and reduced our initial exposure. If the market didn’t perform, we didn’t pay the full amount. If it succeeded, everyone benefited. These tools shared a common trait: they were conditional, performance-linked, and designed to reduce risk while maintaining growth potential. They weren’t about avoiding investment—they were about investing smarter, with built-in safeguards that traditional models lacked.

Building a Financial Safety Net Before You Leap

One of the most important lessons I learned was this: preparation doesn’t start when you enter a market—it starts long before. Today, before launching in any new region, I build what I call a financial safety net—a combination of liquidity reserves, flexible credit, and real-time monitoring systems. This isn’t just about having cash on hand; it’s about structuring finances so that liquidity is accessible when needed, without disrupting ongoing operations. The cornerstone of this system is a rolling credit line, which provides on-demand access to capital without the burden of long-term debt. We use it not for growth, but for resilience—covering unexpected delays, bridging cash flow gaps, or responding to regulatory changes.

Equally important is automated cash flow forecasting. We integrated our accounting software with market data platforms to create dynamic financial models that update in real time. These models project cash flow under different scenarios—optimistic, realistic, and worst-case—allowing us to anticipate challenges months in advance. For example, when a key supplier in Asia faced production delays, our system flagged a potential shortfall in inventory funding. Because we had visibility and backup financing in place, we were able to secure alternative suppliers and adjust payment terms without halting operations. This kind of proactive management wouldn’t have been possible with static spreadsheets or annual budgets.

The safety net also includes insurance products tailored to international operations, such as political risk insurance and trade credit insurance. These protect against non-payment by foreign buyers or disruptions caused by regulatory shifts. While they add to operational costs, they provide peace of mind and prevent catastrophic losses. Together, these elements form a financial buffer that doesn’t slow down expansion—it makes it safer and more sustainable. The goal isn’t to avoid risk entirely, but to ensure that no single setback can derail the entire effort. When you enter a new market with this foundation, you’re not gambling—you’re positioning yourself to adapt, survive, and thrive.

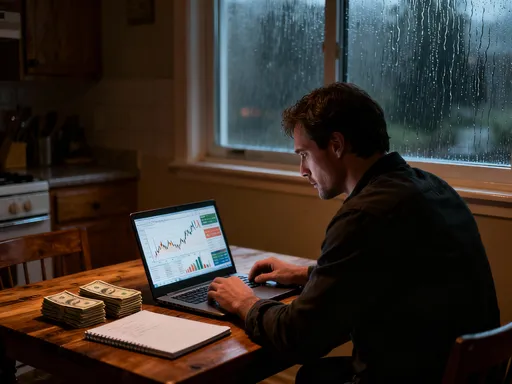

Data-Driven Decisions: Matching Tools to Market Signals

In the past, I made expansion decisions based on intuition, anecdotal feedback, or broad market reports. That changed when I began integrating predictive analytics into our financial planning. Today, we use data platforms that combine customer behavior, sales trends, and economic indicators to generate real-time insights. These aren’t just dashboards—they’re decision engines. For instance, when we noticed a consistent rise in website traffic and inquiry volume from Southeast Asia, the data triggered a deeper analysis. Instead of launching a full-scale operation, we initiated a targeted pilot using localized financing tools, such as regional revenue-based lenders who understood the market’s payment cycles and consumer habits.

This data-driven approach allowed us to match the right financial tool to the right market at the right time. In markets with high volatility, we prioritized hedging and flexible financing. In more stable regions with predictable demand, we used traditional loans or internal capital. The key was alignment: ensuring that the financial instrument matched the risk profile and growth trajectory of each market. One of our most successful pilots began with a 90-day test in Vietnam, funded by a local fintech platform that offered six-month revenue-sharing terms. Because the repayment was tied to actual sales, we could test the market with minimal downside. When the pilot exceeded expectations, we scaled using a combination of retained earnings and performance-based equity.

The power of this strategy lies in its precision. Instead of applying the same financial model everywhere, we now customize our approach based on data. We track metrics like customer acquisition cost, payment delay rates, and currency exposure, then select tools that mitigate the highest risks. This has led to a 32% improvement in return on invested capital across new markets. More importantly, it has reduced wasted spending and increased confidence in every decision. When you base your financial choices on real signals rather than assumptions, expansion becomes a series of calculated moves, not leaps of faith.

Avoiding the Traps: Common Mistakes in Scaling Finances

Even with the right tools, scaling across markets is fraught with pitfalls. I’ve made my share of mistakes, and each one taught me something valuable. One of the most costly was overleveraging during our European rollout. Excited by early traction, I used multiple financing sources simultaneously—revenue-based loans, credit lines, and supplier credit—without fully modeling the combined repayment burden. When sales growth slowed due to seasonal factors, the overlapping obligations strained our cash flow. We weren’t insolvent, but we were forced to delay other initiatives and renegotiate terms, damaging our credibility with some partners.

Another mistake was failing to account for local tax structures. In one country, I assumed our standard pricing model would work, only to discover that value-added tax rules significantly reduced our net margins. Because we hadn’t consulted local financial experts early enough, we faced a six-month adjustment period that cut into profitability. These weren’t failures of execution—they were failures of foresight. The lesson was clear: every market has its own financial ecosystem, and what works elsewhere may not transfer directly.

Other common traps include mismatched financing timelines—using short-term debt for long-term investments—and ignoring currency mismatches, such as earning in local currency but repaying in dollars. These create hidden risks that compound over time. The solution is not to avoid complexity, but to build systems that expose it early. We now conduct a financial risk assessment for every new market, evaluating factors like regulatory stability, currency convertibility, and banking reliability before committing capital. We also stress-test our financing plans under adverse conditions. These practices don’t eliminate risk, but they ensure we enter each market with eyes wide open.

Putting It All Together: A Smarter Path to Growth

Scaling a business across markets doesn’t have to be a high-stakes gamble. My journey taught me that sustainable growth comes not from chasing every opportunity, but from choosing the right ones with the right tools. The shift from reactive spending to strategic investing transformed how I view expansion. Today, I don’t see new markets as blank slates for aggressive growth—I see them as complex financial environments that require tailored solutions. The tools I rely on—revenue-based financing, cash flow hedging, dynamic forecasting, and performance-linked equity—are not magic bullets. They are practical instruments that align capital with reality, reduce uncertainty, and protect hard-earned progress.

What matters most is the mindset. It’s about treating financial planning not as a back-office function, but as a core driver of strategy. It’s about building resilience before you need it, making decisions based on data rather than emotion, and recognizing that control is just as important as speed. For entrepreneurs, especially those balancing business with family and personal responsibilities, this approach brings more than financial benefits—it brings peace of mind. You can grow with confidence, knowing that your business is structured to withstand surprises and adapt to change.

Expansion will always involve risk, but it doesn’t have to involve recklessness. By using investment tools that are flexible, transparent, and aligned with actual performance, you can scale with purpose. You don’t need to sacrifice stability for growth—you can have both. The path to sustainable success isn’t about how fast you move, but how wisely you invest. And when you get that balance right, growth stops feeling like a gamble and starts feeling like progress.