How I Finally Got My Money Working Without Losing Sleep

Remember that sinking feeling when your investments swing wildly, but you’re not sure what to do? I’ve been there—watching markets panic, second-guessing every move. Then I discovered a smarter way to manage my money: not by chasing returns, but by building a balanced plan that actually fits my life. This isn’t about getting rich quick. It’s about making your money work steadily while keeping risk under control. Here’s how I did it—and how you can too.

The Wake-Up Call: Why I Stopped Chasing Returns

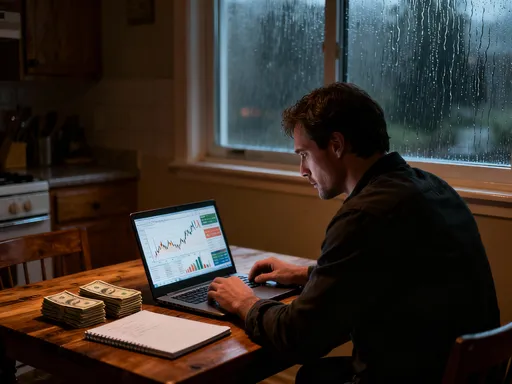

For years, I believed the myth that successful investing meant picking the right stock at the right time and holding on for explosive gains. I watched financial news daily, scanned headlines for clues, and moved money impulsively when markets shifted. My portfolio looked strong during bull runs, but one sharp downturn changed everything. In just a few weeks, I lost nearly 30% of my portfolio’s value—not because of a single bad decision, but because I had no real strategy to fall back on. That experience was a wake-up call. I realized I wasn’t investing; I was speculating. The emotional toll was just as damaging. I found myself checking balances at odd hours, feeling anxious before earnings reports, and losing sleep over market volatility. That’s when I began to ask the right question: not “How much can I make?” but “How can I protect what I have while still growing it steadily?”

The shift started with understanding the difference between speculation and disciplined investing. Speculation relies on timing, luck, and emotion. True investing is systematic, patient, and rooted in long-term planning. I began reading about proven strategies used by financial advisors and long-term investors—those who didn’t get rich overnight but built wealth consistently over decades. What stood out was not their stock picks, but their process. They focused on structure: how money was allocated, how risk was managed, and how behavior was controlled. I realized my biggest problem wasn’t market performance—it was my own reaction to it. Without a clear plan, I was vulnerable to fear and greed, the two forces that derail most investors.

So I made a commitment: no more chasing trends. Instead, I would build a strategy based on my actual life goals, risk tolerance, and time horizon. This meant stepping back from daily market noise and focusing on what I could control. I didn’t need to predict the future; I needed a framework that could withstand uncertainty. That framework began with one foundational principle: asset allocation.

Asset Allocation: The Quiet Engine Behind Steady Growth

If there’s one concept that transformed my financial journey, it’s asset allocation. At first glance, it sounds technical—something only financial advisors talk about. But in reality, it’s the backbone of every successful long-term investment strategy. Asset allocation refers to how you divide your money among different types of investments—primarily stocks, bonds, real estate, and cash. The goal isn’t to pick winners, but to spread risk so that no single market move can derail your progress. What surprised me most was learning that allocation, not stock selection, drives the vast majority of investment returns. Studies from respected financial institutions show that over 90% of the variability in portfolio performance comes from how money is allocated across asset classes, not from picking individual winners.

This insight changed everything. I had spent years obsessing over which stock to buy next, when the real power was in the overall structure of my portfolio. A well-allocated portfolio doesn’t promise the highest returns in a bull market, but it also avoids catastrophic losses in downturns. It’s designed to grow steadily over time, not in bursts. For example, during a strong stock market, bonds may underperform—but they act as a stabilizer, reducing overall volatility. When stocks drop, bonds often hold their value or even rise, helping to cushion the blow. Real estate and cash equivalents provide additional layers of balance, offering income and liquidity when needed.

The key to effective asset allocation is personalization. There’s no one-size-fits-all mix. Your ideal allocation depends on several factors: your age, your financial goals, your time horizon, and how much market fluctuation you can tolerate emotionally and financially. A young investor saving for retirement might hold 80% in stocks and 20% in bonds, accepting higher volatility for greater long-term growth. Someone nearing retirement might shift to 50% stocks and 50% bonds, prioritizing capital preservation. I took the time to assess my own situation honestly. I wasn’t as aggressive as I once thought. Knowing I couldn’t afford to lose a large portion of my savings in a downturn, I chose a moderate allocation that balanced growth potential with downside protection.

What makes asset allocation so powerful is that it removes the need to time the market. You’re not trying to guess when to get in or out. Instead, you’re building a portfolio that’s designed to perform across different economic environments. Over time, this approach leads to more consistent results and less emotional stress. It’s not flashy, and it won’t make headlines—but it’s what allows real wealth to build quietly and reliably.

Building Your Mix: Matching Investments to Life Goals

Once I understood the importance of asset allocation, the next step was designing a portfolio that reflected my actual life—not just abstract financial targets. I realized my money had different jobs to do, and each job required a different type of investment. That’s when I adopted the “bucket strategy,” a simple but powerful way to organize my savings based on timing and purpose. I divided my money into three clear categories: growth, stability, and liquidity. Each bucket has its own time horizon and risk profile, making it easier to stay focused and avoid emotional decisions.

The growth bucket is for long-term goals—things I won’t need for at least ten years, like retirement or a child’s education. This is where I allocate the largest share of equities, including low-cost index funds that track the broader stock market. Because I have time to recover from downturns, I can afford to take on more risk in this bucket for the sake of higher potential returns. I reinvest dividends and let compounding work over decades. The key is consistency: I contribute regularly, regardless of market conditions, knowing that time in the market beats timing the market.

The stability bucket supports mid-term goals—those five to ten years away, such as a home down payment or a major family expense. Here, I focus on income-producing assets like high-quality bonds, dividend-paying stocks, and real estate investment trusts (REITs). These investments are less volatile than growth stocks and provide a steady stream of income. They also help balance the portfolio when the stock market fluctuates. By allocating a portion of my savings here, I ensure that I won’t be forced to sell stocks at a loss if I need funds during a downturn.

The liquidity bucket is for short-term needs and emergencies—money I might need within the next one to three years. This includes my emergency fund, upcoming bills, and unexpected expenses. It’s held in cash or cash equivalents like high-yield savings accounts, money market funds, or short-term certificates of deposit. These accounts are low-risk and highly accessible, ensuring I can cover urgent needs without touching my long-term investments. Having this bucket in place has been a game-changer. It gives me peace of mind, knowing I won’t have to liquidate stocks in a market dip just to cover car repairs or medical bills.

By assigning each dollar a clear purpose, I’ve removed much of the emotional uncertainty from investing. When the market drops, I don’t panic—because I know my emergency fund is safe, my mid-term goals are protected, and my long-term investments have time to recover. This structure doesn’t eliminate risk, but it makes it manageable and predictable.

Rebalancing: The Reset Button That Keeps You on Track

Even the best-designed portfolio won’t stay balanced on its own. Markets move, and so do your asset allocations. Over time, some investments grow faster than others, causing your original mix to drift. For example, if stocks perform well, they may grow from 60% of your portfolio to 75%, increasing your exposure to risk. This doesn’t mean you’ve made a mistake—it’s just how markets work. But if left unchecked, this drift can turn a carefully planned strategy into an overly aggressive or overly conservative one, depending on market conditions. That’s where rebalancing comes in.

Rebalancing is the process of bringing your portfolio back to its target allocation. It’s like hitting a reset button. If stocks have grown too large a share, you sell some and use the proceeds to buy more bonds or cash, restoring balance. If bonds have outperformed and now dominate, you may shift some back into stocks. This practice forces you to sell high and buy low—a principle that sounds simple but is emotionally difficult for most investors. In reality, people tend to do the opposite: they buy more of what’s been rising and sell what’s falling, locking in losses and missing future gains.

I rebalance my portfolio twice a year—once in the spring and once in the fall. I review each bucket and check whether any asset class has drifted more than 5% from its target. If it has, I make adjustments. For example, if my stock allocation has risen from 60% to 68%, I’ll sell enough equities to bring it back to 60% and reinvest in bonds. This isn’t about predicting the market; it’s about maintaining discipline. Rebalancing doesn’t guarantee higher returns, but it does reduce risk and improve long-term consistency. It also helps me avoid becoming overexposed to any single asset class, which could lead to larger losses during a correction.

Some investors worry that rebalancing means missing out on continued gains. But the goal isn’t to capture every uptick—it’s to stay aligned with your long-term plan. By locking in profits during strong periods and reinvesting in undervalued areas, you’re building resilience. Over time, this disciplined approach leads to smoother growth and fewer emotional decisions. Rebalancing isn’t exciting, and it won’t make you rich overnight. But it’s one of the most effective tools for staying on track and avoiding costly mistakes.

Risk Control: Protecting What You’ve Built

We often focus so much on growing wealth that we forget the importance of preserving it. But in investing, avoiding big losses is just as crucial as achieving gains. A 50% loss doesn’t just set you back—it requires a 100% gain just to return to where you started. That’s why risk control isn’t about fear or pessimism; it’s about respect for the long-term process. I’ve learned that protecting capital isn’t passive—it requires active decisions about diversification, position sizing, and emotional discipline.

One of the most effective ways I manage risk is through diversification—not just across asset classes, but within them. For example, instead of investing only in U.S. stocks, I include international equities to spread exposure across different economies and currencies. Within bonds, I hold a mix of government, municipal, and corporate bonds with varying maturities. This reduces the impact of any single market event. I also avoid overconcentration in any one company or sector. Early in my investing journey, I held a large portion of my portfolio in my employer’s stock, believing it was a safe bet. When the company faced unexpected challenges, I watched that portion lose significant value. That taught me a hard lesson: no single stock, no matter how strong, should dominate your portfolio.

I also size my positions carefully. No single investment makes up more than 5–10% of my total portfolio, depending on the asset class. This ensures that even if one investment fails, it won’t derail my overall plan. I apply the same principle to alternative investments like real estate or commodities—they’re included, but in modest amounts that support diversification without increasing risk.

Another key part of risk control is emotional discipline. I’ve set clear rules for myself: no panic selling during downturns, no chasing hot trends, and no making decisions based on news headlines. I remind myself that market volatility is normal and expected. In fact, downturns can be opportunities—if you have the liquidity and mindset to take advantage of them. By focusing on what I can control—allocation, diversification, and behavior—I’ve built a portfolio that can withstand uncertainty without requiring constant attention.

Practical Moves: Tools and Habits That Make It Stick

Even the best strategy fails without execution. I’ve learned that consistency comes not from willpower, but from systems. I automate as much as possible: monthly contributions to my retirement and investment accounts are set up on autopilot. This ensures I stay disciplined, even during busy or stressful times. I also prioritize tax-advantaged accounts like 401(k)s and IRAs, where my money can grow without being taxed annually. Every dollar saved on fees or taxes is a dollar that stays invested and continues to compound.

I keep costs low by using low-cost index funds and exchange-traded funds (ETFs). These funds track broad market indices, providing instant diversification at a fraction of the cost of actively managed funds. Over time, lower fees translate into higher net returns—a small difference that adds up significantly over decades. I also avoid frequent trading, which can trigger taxes and erode gains. Instead, I focus on long-term ownership and steady contributions.

To stay on track, I review my progress quarterly. I don’t obsess over daily fluctuations, but I do check my allocation, performance, and goals every few months. I use a simple dashboard—a single page that shows my asset mix, year-to-date returns, and progress toward key milestones. This keeps things clear and manageable. If something is off track, I make adjustments during my regular rebalancing. The goal isn’t perfection; it’s progress.

These habits—automation, low costs, tax efficiency, and regular reviews—have made a huge difference. They reduce the emotional burden of managing money and help me stay focused on the long term. I no longer feel the need to react to every market shift. Instead, I trust the process.

The Long Game: Why Patience Pays More Than Precision

Looking back, the biggest shift in my financial life wasn’t a single investment decision—it was a change in mindset. I used to believe that success required constant optimization: finding the perfect fund, timing the market, or discovering the next big trend. Now I understand that the real advantage lies in patience and consistency. Wealth isn’t built in a day; it’s built through small, smart decisions repeated over time. A solid asset allocation, left undisturbed, compounds quietly and reliably. Markets will rise and fall. News will come and go. But a disciplined approach, followed consistently, delivers results.

The most powerful force in investing isn’t intelligence or timing—it’s time. The earlier you start, the more your money can grow through compounding. But even if you start later, the principles remain the same: define your goals, build a balanced plan, control risk, and stay the course. Emotional discipline is more valuable than financial knowledge. The ability to ignore noise, avoid panic, and stick to your plan is what separates successful investors from those who chase returns and burn out.

Today, I no longer lose sleep over my investments. Not because I’ve eliminated risk—but because I’ve built a system that manages it. My money is working for me, not the other way around. I’ve stopped chasing returns and started building lasting financial security. And the best part? Anyone can do it. You don’t need a finance degree or a six-figure income. You need clarity, a plan, and the willingness to stay the course. Because in the end, the most powerful investment you can make is in yourself—and in the discipline to let your money grow steadily, year after year.