How I Survived a Job Loss with Smarter Money Moves

Losing my job last year hit harder than I expected—not just emotionally, but financially. I quickly realized my savings weren’t enough to cover even three months of expenses. That panic pushed me to rethink everything about money. I started breaking down how to protect myself if it ever happens again. The biggest game-changer? Learning to diversify my assets in ways I’d never considered before. This is what actually worked when the paycheck stopped.

The Wake-Up Call: When the Paycheck Stops

The email arrived on a Tuesday morning. No warning, no performance review—just a short message confirming my position was eliminated due to company restructuring. I sat at my kitchen table, coffee cooling in front of me, staring at the screen, trying to process what had just happened. I had always considered myself a reliable employee, someone who showed up early and stayed late when needed. But none of that mattered in the face of budget cuts and shifting priorities. The emotional toll was immediate—feelings of rejection, uncertainty, and fear crept in within hours. Yet the financial reality set in even faster. My monthly income, the foundation of my budget, vanished overnight.

At first, I told myself it would be okay. I had savings, after all. But when I reviewed my accounts, the truth was harder to ignore. My emergency fund covered only about seven weeks of essential bills—rent, utilities, groceries, insurance. I hadn’t accounted for job search costs, potential gaps in health coverage, or the psychological strain of living on dwindling resources. Within a month, I was checking my bank balance twice a day, flinching at every automatic withdrawal. The stress affected my sleep, my focus, and even my relationships. I began to understand that financial security wasn’t just about earning a steady paycheck—it was about having systems in place that could sustain me when that paycheck disappeared.

This experience exposed a flaw in the way many of us think about money: the assumption that employment equals stability. We plan our lives around expected income, from mortgage payments to retirement contributions, rarely questioning how fragile that foundation can be. Market downturns, technological shifts, and organizational changes can all lead to job loss, often without warning. The reality is that no job is completely safe, no matter how skilled or dedicated an employee may be. What separates those who survive such setbacks from those who struggle is not luck, but preparation. That realization became the catalyst for a complete reevaluation of my financial habits and long-term strategy.

Why Asset Diversification Isn’t Just for the Rich

Before my job loss, the term “asset diversification” sounded like something reserved for wealthy investors managing large portfolios. I associated it with Wall Street professionals, stock portfolios, and financial advisors charging high fees. I assumed it had little relevance to someone like me, living paycheck to paycheck with modest savings. But as I began researching ways to rebuild my financial safety net, I came to understand that diversification is not about wealth—it’s about resilience. At its core, asset diversification means spreading your financial resources across different types of income and investments so that the failure of one does not lead to total collapse. It’s a risk management strategy, not a luxury.

Think of it like this: if you rely solely on your job for income, you’re essentially keeping all your financial eggs in one basket. If that basket breaks—due to layoffs, industry decline, or health issues—you’re left with nothing to fall back on. Diversification is the act of placing some of those eggs into other containers: emergency savings, side income, passive investments, and insurance protections. Each of these serves a different purpose, but together, they create a more stable financial foundation. The goal is not to get rich quickly, but to reduce vulnerability and increase control over your financial future.

One common misconception is that diversification requires a large amount of money to get started. This is simply not true. You don’t need thousands of dollars to begin building alternative income streams or setting up a basic emergency fund. What matters most is consistency and intentionality. For example, setting aside just $50 a month into a high-yield savings account can grow into a meaningful cushion over time. Similarly, using existing skills to take on freelance work—even a few hours a week—can generate additional income without requiring major upfront investment. The key is to start where you are, with what you have, and gradually expand your financial toolkit.

Another myth is that diversification is only about stocks and bonds. While investing is an important component, true financial diversification includes multiple layers: liquid savings, human capital (your skills and ability to earn), passive income sources, and risk protection through insurance. Each of these plays a role in creating a balanced financial life. By understanding that diversification is accessible to everyone—not just the wealthy—you can begin making smarter decisions today that protect your future, regardless of your current income level.

Building Your Financial Safety Net: The First Layer

After my job loss, the first step I took was to rebuild my emergency fund—a financial buffer designed to cover essential living expenses during unexpected setbacks. I had heard the advice before: save three to six months’ worth of expenses. But until I faced a real crisis, I hadn’t taken it seriously. Now, I understood that this fund wasn’t just a suggestion—it was a necessity. Without it, even a short gap in income could lead to debt, late fees, or worse, the loss of housing or healthcare. So I committed to creating a dedicated safety net, separate from my regular checking account and other savings goals.

I started by calculating my essential monthly expenses: rent, utilities, groceries, transportation, insurance premiums, and minimum debt payments. The total came to about $3,200. Multiplying that by six, I set a target of $19,200 for my full emergency fund. That number felt overwhelming at first, especially since I was now unemployed. But I reminded myself that I didn’t have to reach the goal overnight. I broke it down into smaller, manageable milestones—first $1,000, then $5,000, and so on. This made the process less intimidating and allowed me to celebrate small wins along the way.

To fund this account, I took several practical steps. I reviewed my budget and eliminated all non-essential spending—subscriptions I rarely used, dining out, impulse purchases. I redirected that money into my emergency fund. I also set up automatic transfers from my main account to a high-yield savings account, treating the transfer like a non-negotiable bill. Even when I started earning again, I prioritized this fund over other financial goals like vacations or luxury items. I also used a portion of my severance package to jumpstart the account, knowing that this money was meant to bridge the gap, not fund short-term comfort.

Equally important was keeping the fund accessible and protected. I chose a savings account with no withdrawal penalties and easy online access, ensuring I could use the money quickly if needed. At the same time, I kept it at a different bank than my checking account to reduce the temptation to dip into it for everyday spending. This separation created a psychological barrier that helped me stay disciplined. Over time, watching the balance grow gave me a sense of control and reduced the anxiety that had once consumed me. Building this financial safety net wasn’t glamorous, but it was transformative—it gave me breathing room to search for a new job without panic dictating my choices.

Beyond Savings: Turning Skills into Side Income Streams

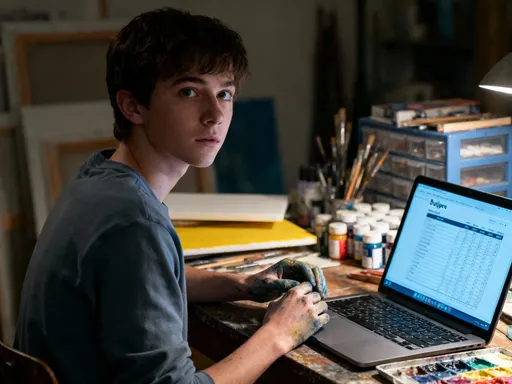

While rebuilding my emergency fund was crucial, I knew I needed more than just savings to regain stability. I needed income. But instead of rushing into the first job offer that came my way, I decided to explore ways to generate income on my own terms. I began by asking myself a simple question: What skills do I already have that others might pay for? I had spent over a decade working in marketing, managing social media campaigns, writing content, and analyzing data. These were not just job duties—they were marketable skills that could be offered independently.

I started small, taking on freelance writing projects through online platforms. The pay was modest at first, but it gave me flexibility and helped me rebuild confidence. As I completed more assignments, I gained testimonials and referrals, which led to higher-paying clients. I also began offering social media consulting to small businesses, helping them improve their online presence. These side gigs didn’t replace my full-time salary immediately, but they provided a steady stream of income that reduced my reliance on savings. More importantly, they reminded me that my value wasn’t tied to a single employer—it was in my abilities and experience.

One of the most valuable lessons I learned was the importance of starting before you need to. If I had waited until I lost my job to explore side income, I would have been under pressure to accept any offer, regardless of pay or fit. But because I began testing these opportunities while still employed, I could experiment, learn, and build a client base without financial desperation. Now, I encourage others to do the same—use your current stability to explore what else you can do. Even dedicating five to ten hours a week to a side project can create an alternative income path that may one day become a lifeline.

Another key was knowing where to find opportunities. I used reputable freelance platforms, joined professional networks, and reached out to former colleagues to let them know I was available for contract work. I also invested in improving my skills through free online courses, which made me more competitive. The goal wasn’t to become an overnight entrepreneur, but to diversify my income sources so that if one disappeared, others could help fill the gap. Human capital—your knowledge, skills, and ability to work—is one of the most powerful assets you have. By treating it as such, you can build financial resilience that goes beyond traditional employment.

Investing in Low-Effort Assets That Work for You

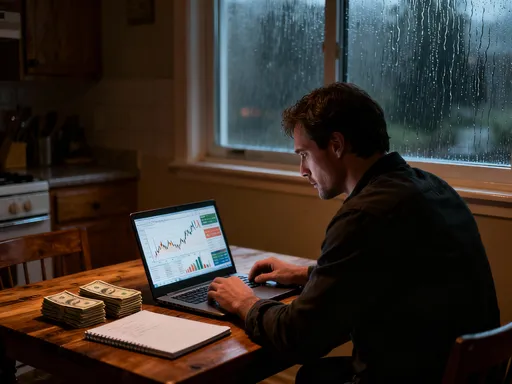

Once I had stabilized my immediate finances, I turned my attention to long-term wealth building. I had always been intimidated by investing, assuming it required deep financial knowledge, constant monitoring, and large sums of money. But as I read more, I realized that passive investing—putting money into diversified, low-cost funds and letting it grow over time—was not only accessible but essential for financial security. I decided to start small, focusing on options that required minimal effort but offered steady growth potential.

I began with index funds, which track broad market averages like the S&P 500. These funds are designed to mirror the performance of the overall market, spreading risk across hundreds of companies. Because they are passively managed, they have lower fees than actively managed funds, which means more of my money stays invested. I opened an account with a reputable brokerage that offered no minimum deposits and low trading fees. I started by contributing $100 a month, automatically scheduled on payday. It wasn’t a large amount, but I knew that consistency mattered more than size when it came to compounding returns.

I also explored dividend-paying stocks and exchange-traded funds (ETFs). Dividends are payments made by companies to their shareholders, usually on a quarterly basis. By reinvesting these dividends, I could buy more shares over time, accelerating growth without adding more money out of pocket. ETFs, like index funds, offer diversification but trade like individual stocks, giving me flexibility. I focused on funds with strong track records and low expense ratios, avoiding speculative stocks or complex financial products I didn’t fully understand.

One of the most important shifts in my mindset was learning to distinguish between investing and speculation. Buying a single stock based on a rumor or trying to time the market is not investing—it’s gambling. True investing is about patience, discipline, and long-term planning. I accepted that markets would fluctuate, and some years my portfolio might lose value. But history shows that over time, the market tends to rise, and those who stay invested benefit from that growth. By adopting a long-term perspective, I reduced anxiety and avoided the temptation to make emotional decisions during downturns. This approach didn’t make me rich overnight, but it gave me a sense of progress and purpose in rebuilding my financial future.

Protecting What You Have: Risk Management Essentials

After losing my job, I also lost access to employer-sponsored benefits—health insurance, disability coverage, and life insurance. At first, I assumed I could go without, especially since I was relatively healthy. But a minor medical issue a few months later—a visit to the urgent care clinic—resulted in a bill that reminded me how quickly unexpected costs can arise. I realized that protecting my financial progress wasn’t just about earning and saving—it was also about guarding against worst-case scenarios. Insurance and basic legal protections became a critical part of my financial strategy.

I started by shopping for an individual health insurance plan through the marketplace. It was more expensive than my employer-sponsored coverage, but I found a mid-tier plan that balanced cost and coverage. I made sure it included preventive care, prescription drugs, and access to specialists, knowing that early treatment could prevent more serious (and costly) issues down the road. I also reviewed disability insurance, which provides income if you’re unable to work due to illness or injury. Given that I now relied on multiple income streams, protecting my ability to earn was essential. I chose a policy with a reasonable waiting period and a benefit amount that covered a portion of my monthly expenses.

Life insurance was another consideration, especially as a single parent. While it was uncomfortable to think about, I knew that a term life policy could provide financial security for my child in the event of my passing. I selected a 20-year term plan with a coverage amount that would cover living expenses, education costs, and final bills. The premiums were affordable, and the peace of mind was invaluable. In addition to insurance, I took steps to organize my legal documents. I created a simple will, outlining how my assets should be distributed, and designated a trusted person as power of attorney to make decisions if I were incapacitated. These actions didn’t change my daily life, but they ensured that my family would be protected if the unexpected occurred.

Risk management isn’t about expecting disaster—it’s about preparing for it so you can live with greater confidence. By addressing these protections, I reduced the fear of financial catastrophe and strengthened my overall resilience. These safeguards work quietly in the background, much like a seatbelt or smoke detector, unnoticed until they’re needed. But when they are, they can make all the difference.

Putting It All Together: My Diversified Financial Plan

Looking back, the most powerful change wasn’t any single action—it was the shift from a one-dimensional financial life to a diversified one. I had once relied entirely on my job. Now, I had multiple layers of protection and growth. My financial plan wasn’t perfect, but it was balanced, intentional, and adaptable. I visualized it as a stool with three legs: emergency savings, side income, and long-term investments. If one leg weakened, the others could hold me up.

My emergency fund, now fully funded with six months of expenses, sits in a high-yield savings account, untouched except for true emergencies. It’s my first line of defense. My side income, though inconsistent, provides a buffer and keeps my skills sharp. I continue to take on freelance projects, not because I need the money, but because they offer flexibility and creative fulfillment. My investment portfolio, though modest, grows steadily through regular contributions and compounding. I review it quarterly, but I don’t obsess over daily fluctuations. I’ve also maintained my insurance coverage and legal documents, updating them as my life changes.

What I wish I had known earlier is that financial security isn’t about earning more—it’s about managing what you have wisely. You don’t need a six-figure salary to build resilience. You need consistency, discipline, and a willingness to learn. I made mistakes along the way—delaying my emergency fund, underestimating insurance needs, hesitating to invest. But each misstep taught me something valuable. The key is not to aim for perfection, but to keep moving forward, adjusting as life changes.

This new approach has done more than stabilize my finances—it has reduced my anxiety and given me a sense of control. I no longer live in fear of the next layoff. I know that if it happens, I have options. That peace of mind is worth more than any dollar amount.

Staying Ready Without Living in Fear

Financial resilience isn’t about avoiding risk—it’s about preparing for it with clarity and confidence. My job loss was painful, but it became a turning point. It forced me to confront the fragility of relying on a single income source and to build a more balanced, sustainable financial life. Asset diversification is not a one-time fix; it’s an ongoing practice, a habit of mind that values security, adaptability, and long-term thinking.

The steps I took—building an emergency fund, creating side income, investing consistently, and protecting against risks—are not extraordinary. They are accessible to anyone, regardless of income level. What matters most is starting, even with small actions. Set aside a little each month. Learn a new skill. Review your insurance. These choices compound over time, just like money. The goal isn’t wealth for its own sake, but peace of mind—the quiet confidence that you can handle whatever life brings.

I still work, and I hope to for many years. But I no longer define my security by my job title or paycheck. I define it by my preparedness, my flexibility, and my ability to adapt. That’s the real measure of financial health. And it’s a lesson I carry with me every day.