Tax Traps When Preparing for a Newborn? I Learned the Hard Way

Bringing a new baby into the world is overwhelming—and so is the financial maze that comes with it. I thought we were prepared until tax season hit. Suddenly, missed credits, overlooked deductions, and avoidable mistakes cost us hundreds. What we didn’t know about tax planning hurt us. If you're preparing for a newborn, don’t make the same errors. Let me walk you through the real pitfalls and how to steer clear.

The Overwhelming Reality of Newborn Financial Planning

Welcoming a newborn brings profound joy, but it also ushers in a wave of financial decisions that can catch even the most organized families off guard. While many parents focus on purchasing cribs, preparing for hospital stays, and planning parental leave, few pause to consider how these choices affect their tax obligations. The reality is that from the moment a baby is born, every financial move—whether it’s adjusting income, claiming benefits, or paying medical bills—can have lasting tax implications. Without proactive planning, families often miss valuable tax-saving opportunities or inadvertently create liabilities that could have been avoided.

For many, the emotional and logistical demands of preparing for a newborn take precedence over tax strategy. Hospital tours, baby showers, and sleepless nights dominate the conversation, while discussions about W-4 forms, Flexible Spending Accounts (FSAs), and dependent exemptions are left for later. But delaying these conversations can be costly. For example, failing to update payroll withholding after the birth of a child may result in under-withholding, leading to an unexpected tax bill months down the line. Similarly, not knowing the rules around claiming a dependent can mean missing out on thousands in potential credits.

The intersection of life events and tax policy is often overlooked, yet it’s one of the most critical areas of personal finance. A new baby changes household size, income patterns, and eligibility for government benefits—all of which are tracked by the IRS. Families who assume that tax filing will “sort itself out” during the next return may be in for a surprise. The truth is, tax planning for a newborn isn’t just about paperwork; it’s about aligning major life transitions with financial systems that reward foresight and penalize oversight. Those who take the time to understand the rules early often find themselves better positioned to save money, reduce stress, and build long-term financial stability.

Misunderstanding Dependent Exemptions and Child Tax Credits

One of the most significant tax benefits available to new parents is the Child Tax Credit, yet many families fail to claim it correctly—or at all—due to misunderstandings about eligibility and timing. The credit, worth up to $2,000 per qualifying child under the age of 17, can reduce a family’s tax bill dollar for dollar. However, simply having a newborn does not automatically guarantee receipt of the full amount. Income levels, filing status, and proper documentation all play crucial roles in determining how much a family can claim.

A common misconception is that parents must claim their child in the first year of life or lose the benefit permanently. This is not true—the credit applies to each year the child qualifies, regardless of whether it was claimed previously. However, to claim the credit, the child must have a valid Social Security number (SSN) issued before the tax filing deadline. Families who delay applying for their baby’s SSN may find themselves unable to claim the credit for that tax year, even if the child was born in December. This single oversight can result in a missed opportunity worth hundreds or even thousands of dollars.

Another area of confusion involves phase-out thresholds. The Child Tax Credit begins to reduce for married couples filing jointly with modified adjusted gross income (MAGI) above $400,000 and for single filers above $200,000. While this may seem out of reach for many families, those with variable incomes—such as freelancers or commission-based workers—should be aware that a high-earning year could limit their eligibility. Additionally, the credit is partially refundable, meaning that even families who owe little or no federal income tax may still receive a portion of the credit as a refund, up to $1,600 per child in 2023.

Beyond the Child Tax Credit, families may also qualify for the Credit for Other Dependents, which provides up to $500 for dependents who don’t meet the age or relationship requirements for the Child Tax Credit—such as older children or other relatives living in the household. To claim any dependent, the individual must meet specific IRS criteria, including relationship, residency, and support tests. Ensuring that all documentation is in order—especially the child’s birth certificate and SSN—should be a top priority for new parents preparing for tax season.

Overlooking Timing: When Your Baby Is Born Matters More Than You Think

The exact date of a baby’s birth can have a surprisingly large impact on a family’s tax situation. A child born on December 31 qualifies as a dependent for the entire tax year, making the family eligible for a full year of benefits such as the Child Tax Credit, dependent care deductions, and potential healthcare expense eligibility. In contrast, a baby born on January 1 means those benefits must wait until the following year. While this may seem like a minor distinction, the financial difference can be substantial, especially for families near income thresholds or those planning to use tax-advantaged accounts.

One often-overlooked consequence of timing involves medical expenses and Flexible Spending Accounts (FSAs). FSAs allow employees to set aside pre-tax dollars for qualified medical costs, but the funds are typically use-it-or-lose-it by the end of the plan year. If a baby is born late in the year, parents may incur significant medical bills—such as delivery costs, newborn screenings, or specialist visits—that could have been paid with pre-tax FSA funds. However, if the FSA election was made before the baby’s arrival and the contribution amount was too low, families may miss out on saving hundreds in taxes. Some employers offer a grace period or allow mid-year changes due to a qualifying life event like the birth of a child, but not all do—making it essential to review plan details promptly.

Similarly, the timing of certain expenses can affect eligibility for itemized deductions. For example, if a family pays for infant formula due to medical necessity or covers therapy for postpartum complications, these costs may qualify as deductible medical expenses—but only if they are paid within the correct tax year. Shifting expenses across years without awareness can result in missed deductions. Keeping detailed records and coordinating with healthcare providers and employers can help ensure that all eligible costs are accounted for in the right timeframe.

Additionally, the birth date affects eligibility for health insurance coverage. Most employer-sponsored plans allow newborns to be added within 30 days of birth, with coverage retroactive to the date of birth. This means that any medical services the baby receives immediately after delivery can be billed under the parent’s insurance, reducing out-of-pocket costs. Understanding these timelines and acting quickly can prevent unnecessary expenses and ensure that the family maximizes both insurance and tax benefits from day one.

Employer Benefits and Payroll Missteps During Parental Leave

Parental leave is a critical time for bonding and recovery, but it’s also a period when financial decisions can have long-term tax consequences. Many parents reduce or pause their income during leave without realizing how this affects their access to tax-advantaged benefits. Employer-sponsored programs such as retirement plans, health FSAs, and dependent care assistance are often tied to active employment and payroll contributions, meaning that changes in income can disrupt eligibility or contribution limits.

One common mistake is stopping contributions to a 401(k) or similar retirement plan during unpaid leave. While this may seem necessary due to reduced cash flow, it can result in missed opportunities for employer matching contributions and tax-deferred growth. Some plans allow employees to continue contributions through lump-sum payments or catch-up mechanisms, though these options vary by employer. Even if contributions must pause, understanding the annual limit—$22,500 in 2023, with an additional $7,500 for those age 50 and over—can help families plan to maximize contributions in future years.

Flexible Spending Accounts present another challenge. Employees typically elect a contribution amount at the beginning of the plan year, and those on unpaid leave may no longer have wages from which to deduct FSA funds. However, some employers allow employees to continue participation during leave, especially if it’s protected under the Family and Medical Leave Act (FMLA). Failing to confirm these rules can mean losing access to pre-tax dollars for medical or dependent care expenses, increasing the family’s tax burden unnecessarily.

Dependent care assistance programs (DCAPs), which allow up to $5,000 in employer-provided benefits tax-free, also require active enrollment and often depend on payroll deductions. If a parent returns to work partway through the year, they may still be eligible to contribute, but only up to the prorated limit based on months employed. Understanding how leave impacts these benefits—and communicating with HR early—can help families maintain financial efficiency during a time of reduced income.

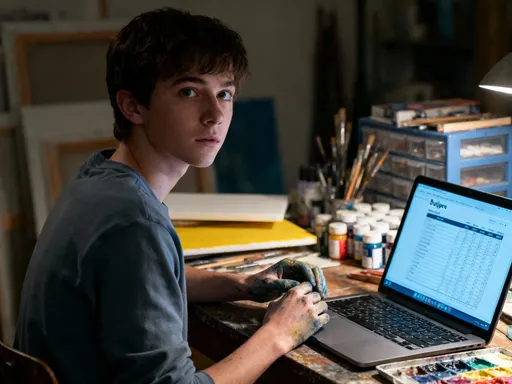

Failing to Adjust Withholding and Estimated Taxes

The arrival of a new child changes a family’s tax bracket, deductions, and overall liability—but many parents fail to update their tax withholding accordingly. The W-4 form, which determines how much federal income tax is withheld from each paycheck, should be revised after major life events like the birth of a child. Without this update, families may have too little tax withheld, leading to a large tax bill or penalties when filing. Conversely, over-withholding means giving the government an interest-free loan, reducing available cash flow during a time when every dollar counts.

The IRS redesigned the W-4 form in 2020 to make it more accurate and easier to use, especially for two-earner households. The new form allows employees to account for multiple jobs, dependents, and other income sources. For new parents, claiming an additional dependent can significantly reduce withholding, increasing take-home pay. Using the IRS Tax Withholding Estimator can help families determine the correct number of allowances or additional withholding amounts to enter on the form.

For self-employed individuals or those with variable income, the stakes are even higher. These taxpayers are responsible for making quarterly estimated tax payments, and the addition of a child introduces new deductions—such as dependent care expenses or home office adjustments—that can affect taxable income. Failing to adjust payments based on these changes can result in underpayment penalties. On the other hand, overpaying means tying up capital that could be used for baby-related expenses or savings.

Proactive tax management during this transition is essential. Reviewing pay stubs, updating withholding forms, and consulting with a tax professional can help ensure that tax obligations are met without surprises. The goal is to align withholding with actual liability, preserving cash flow while avoiding year-end shocks. This small step, often overlooked in the chaos of a newborn’s arrival, can make a meaningful difference in financial peace of mind.

Missing Out on Education and Future Savings Incentives

While college may feel like a distant concern, the birth of a child is actually the perfect time to begin thinking about long-term savings—and the tax advantages that come with it. One of the most powerful tools available is the 529 college savings plan, which offers tax-free growth and withdrawals when funds are used for qualified education expenses. Many states also provide an immediate state income tax deduction or credit for contributions, making these accounts a dual-purpose vehicle for saving and reducing current tax liability.

Despite these benefits, a significant number of parents delay opening a 529 account, often waiting until the child is older. This hesitation means missing out on years of compound growth. For example, contributing just $50 per month from birth, with a modest 6% annual return, could grow to over $30,000 by the time the child turns 18. When combined with state tax savings, the financial advantage becomes even more compelling. Some states even offer matching grants or bonus contributions for low- and middle-income families who participate.

Another option parents consider is the Uniform Gift to Minors Act (UGMA) or Uniform Transfer to Minors Act (UTMA) account. While these custodial accounts allow assets to be held in a child’s name, they come with important tax and financial aid implications. Unlike 529 plans, UGMA/UTMA assets are considered the child’s property and can significantly reduce eligibility for need-based financial aid. Additionally, the “kiddie tax” applies to unearned income over a certain threshold, potentially subjecting investment gains to higher tax rates.

Choosing between these accounts requires careful consideration. 529 plans offer superior tax efficiency and asset protection for education goals, while UGMA/UTMA accounts provide more flexibility in how funds can be used—but at a cost. For most families focused on education, the 529 plan is the better choice. Opening an account early, even with a small initial contribution, establishes a habit of saving and maximizes the benefits of time and tax-advantaged growth.

Building a Sustainable Tax Strategy Beyond the First Year

Tax planning for a newborn shouldn’t end with the first return. As children grow, family circumstances change, and tax laws evolve, ongoing attention is required to maintain financial efficiency. Annual reviews of tax status, benefit enrollment, and savings contributions can help families adapt to new realities and continue maximizing available opportunities. Life events such as job changes, income fluctuations, or the addition of more dependents all warrant a reassessment of withholding, estimated payments, and eligibility for credits.

Staying informed about policy updates is equally important. Tax laws related to dependents, education savings, and healthcare benefits are subject to change. For example, temporary expansions of the Child Tax Credit in recent years demonstrated how quickly rules can shift. While current law remains stable, future legislation could alter phase-out thresholds, credit amounts, or contribution limits. Subscribing to IRS updates, working with a trusted tax advisor, or using reliable financial planning resources can help families stay ahead of these changes.

Integrating tax awareness into broader financial planning ensures long-term resilience. This means aligning savings goals with tax-advantaged accounts, coordinating healthcare and dependent care benefits with life stages, and teaching children about financial responsibility as they grow. The habits established in the early years—such as regular W-4 reviews, consistent 529 contributions, and proactive communication with employers—lay the foundation for a lifetime of informed decision-making.

The birth of a child is more than a personal milestone; it’s a financial turning point. By recognizing the tax implications of this transition and taking deliberate steps to plan ahead, families can avoid common pitfalls, reduce stress, and build a stronger financial future. The lessons learned from early mistakes don’t have to be repeated. With the right knowledge and tools, every parent can turn the chaos of newborn life into a structured, empowered journey toward lasting security.