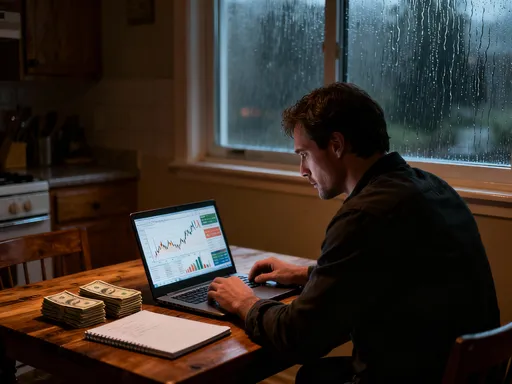

How I Turned My Mortgage Into a Wealth Builder—No Magic, Just Strategy

What if your mortgage wasn’t just a debt but a hidden engine for wealth? I used to see it as a monthly burden—until I shifted my mindset. Through simple, intentional moves, I started aligning my home loan with long-term asset growth. No risky bets, no get-rich-quick schemes. Just practical planning that changed everything. This is how I stopped fearing my mortgage and started using it to build real financial momentum. Over time, I learned that a mortgage, when managed wisely, isn’t an obstacle to wealth—it’s one of the most powerful tools available to everyday people who want to grow their net worth steadily and securely. The key lies not in luck, but in strategy.

Reframing the Mortgage: From Liability to Strategic Asset

For many, the word "mortgage" evokes stress, obligation, and long-term debt. It’s easy to see a home loan as nothing more than a necessary evil—a financial chain that binds you to decades of payments. But this perspective overlooks a fundamental truth: a mortgage is not just a liability; it can be a cornerstone of wealth creation when understood and managed correctly. The shift begins with changing how we view homeownership. Instead of focusing solely on the monthly payment, consider the broader financial structure at play. When you make a mortgage payment, part of it goes toward interest, but another portion reduces the principal—your actual debt. That reduction builds equity, which is the difference between what you owe and what your home is worth. Over time, as property values tend to rise and your loan balance falls, your equity grows.

This growth in equity transforms your home from a place you live into an appreciating asset. Unlike most consumer debt—such as credit cards or auto loans—mortgages are tied to an asset that historically increases in value over the long term. Real estate has consistently outpaced inflation in many markets, meaning that even as prices rise across the economy, your home’s value often rises too. Because mortgage payments are fixed in nominal terms (in the case of fixed-rate loans), inflation effectively reduces the real cost of repayment over time. A $1,500 monthly payment feels much heavier in year one than in year 25, simply because the purchasing power of money declines. This dynamic makes real estate a natural hedge against inflation, adding another layer of financial protection.

Moreover, homeownership allows for forced savings. Rent payments vanish into the landlord’s pocket with no return, but every mortgage payment contributes—directly or indirectly—to building something you own. This automatic accumulation of equity, combined with market appreciation, creates a compounding effect that accelerates wealth over time. Of course, this only holds true if the home is maintained, the market remains stable, and the homeowner avoids overextending financially. Still, the potential is clear: a mortgage, far from being a burden, can function as a disciplined investment mechanism. By reframing it not as a debt trap but as a structured path to ownership and value growth, individuals can begin to harness its full potential.

The Power of Early Equity: Why Timing Matters in Homeownership

The early years of a mortgage are among the most critical for long-term wealth building. While it may seem counterintuitive, the majority of early payments go toward interest rather than principal, especially in the first decade of a 30-year loan. However, this phase sets the foundation for future equity gains. As time progresses, the allocation shifts—each payment reduces the principal slightly more than the last, creating a snowball effect. The earlier you begin to build equity, the more time it has to compound alongside property value appreciation. This dual engine—equity growth through repayment and market-driven value increases—can generate substantial wealth over decades.

Consider a home purchased for $300,000 with a 20% down payment and a 30-year fixed mortgage at 5%. In the first year, only about $3,000 of the roughly $14,000 paid goes toward principal. But by year 15, that same monthly payment applies over $7,000 annually to reducing the loan balance. Meanwhile, if the property appreciates at a conservative 3% per year, its market value grows to nearly $500,000 in 20 years. Even with the remaining loan balance, the homeowner’s equity would exceed $300,000—more than the original purchase price. This example illustrates how time amplifies the benefits of homeownership, turning modest annual gains into significant net worth growth.

Additionally, the earlier you establish equity, the more flexibility you gain in managing your financial future. Strong equity positions open doors to refinancing options, home equity loans for investments or improvements, or even downsizing later in life to free up capital. Delaying homeownership or treating it passively can mean missing out on these compounding advantages. While market fluctuations occur, long-term trends in real estate have historically favored consistent owners over renters. The key is not timing the market perfectly, but starting early and staying committed. By understanding the power of early equity, homeowners can appreciate the importance of patience and consistency in building lasting wealth through real estate.

Smart Prepayments: Accelerating Wealth Without Strain

One of the most effective yet underused strategies for transforming a mortgage into a wealth-building tool is the practice of smart prepayments. Making extra payments toward the principal balance—even small, consistent amounts—can significantly shorten the life of a loan and reduce total interest paid over time. For example, adding just $100 per month to a $250,000, 30-year mortgage at 5% can shave nearly five years off the repayment term and save over $35,000 in interest. These savings represent real money that stays in your pocket instead of going to the lender, effectively increasing your net worth without requiring a major lifestyle change.

The beauty of strategic prepayments lies in their flexibility and accessibility. Unlike aggressive financial overhauls that demand drastic budget cuts, this approach works within existing financial constraints. Many households can find $50 to $200 extra per month by reviewing recurring expenses, optimizing subscriptions, or redirecting modest windfalls like tax refunds or bonuses. The key is consistency rather than size. Regular overpayments, even if small, create momentum. They also provide psychological benefits—seeing the loan balance decline faster can boost motivation and reinforce responsible financial habits.

It’s important to apply prepayments correctly to maximize impact. Extra funds should be explicitly designated for principal reduction, not future payments. Some lenders automatically apply overpayments to the next month’s due date unless instructed otherwise. To ensure the money reduces the principal, borrowers should confirm the payment instructions with their servicer. Additionally, lump-sum payments—such as those made annually—can also be effective, particularly if timed with income spikes or one-time earnings. However, spreading extra payments throughout the year often yields better results due to the continuous reduction in accrued interest.

While prepayments offer clear advantages, they should not come at the expense of other financial priorities. Emergency savings, retirement contributions, and high-interest debt repayment must remain protected. The goal is balance: using surplus cash flow wisely without creating financial strain. When integrated into a broader financial plan, smart prepayments become a sustainable way to accelerate wealth while maintaining stability. Over time, this disciplined approach transforms a standard mortgage into a faster, more efficient path to full ownership and increased net worth.

Leveraging Home Value: When to Refinance (and When Not To)

Refinancing a mortgage is often viewed simply as a way to lower monthly payments by securing a lower interest rate. While this benefit is real and valuable, refinancing can serve a broader strategic purpose when aligned with long-term financial goals. A well-timed refinance can reset loan terms, reduce interest costs, free up cash flow, or even unlock equity for productive use. However, it’s not always the right move, and understanding the full picture is essential to avoid costly mistakes. The decision should be based on more than just current rates—it must consider the homeowner’s stage in life, financial objectives, and overall economic context.

One powerful reason to refinance is to shorten the loan term. Moving from a 30-year to a 15-year mortgage, for instance, typically comes with a lower interest rate and significantly less total interest paid over the life of the loan. While monthly payments may increase, the long-term savings can be substantial. For homeowners who have built equity and improved their credit since purchasing, refinancing can also eliminate private mortgage insurance (PMI), further reducing costs. Additionally, those with adjustable-rate mortgages may choose to refinance into fixed-rate loans to gain stability and predictability in their housing expenses.

Another strategic use of refinancing involves funding home improvements that increase property value. By refinancing to cover the cost of energy-efficient upgrades, kitchen renovations, or accessibility modifications, homeowners can enhance both comfort and resale potential. These investments often yield strong returns, particularly when they align with market demand. However, caution is needed with cash-out refinancing—the process of borrowing more than the current loan balance and taking the difference in cash. While tempting, this approach can erode hard-earned equity if the funds are used for non-essential spending or liabilities that don’t appreciate. Using cash-out proceeds for vacations, luxury items, or credit card debt undermines the wealth-building purpose of homeownership.

Timing and cost are also critical factors. Refinancing involves closing costs, appraisal fees, and other expenses that can add up to thousands of dollars. To justify these costs, the new rate should offer meaningful savings, and the homeowner should plan to stay in the home long enough to recoup the investment—typically at least five to seven years. Rate-and-term refinances that lower the interest rate without extending the loan duration often make the most sense. Ultimately, refinancing should be a deliberate, goal-oriented decision, not a reaction to short-term market fluctuations. When used wisely, it becomes a powerful lever in the broader strategy of turning a mortgage into a wealth accelerator.

Investing in Your Property: Upgrades That Pay Off

A home is more than a shelter—it’s an asset that can grow in value with the right investments. Not all home improvements deliver equal returns, however. Some renovations add significant market value and appeal, while others merely satisfy personal taste without boosting resale potential. To maximize the financial benefit of upgrades, homeowners should focus on projects that offer strong return on investment (ROI), enhance functionality, and align with buyer preferences in their local market. Strategic improvements not only increase equity but also improve daily living, creating a win-win scenario.

Among the most consistently valuable upgrades are those that improve energy efficiency. Replacing old windows with double-paned, energy-efficient models, adding insulation, upgrading to a high-efficiency HVAC system, or installing solar panels can reduce utility bills and attract environmentally conscious buyers. Many of these improvements also qualify for tax incentives or rebates, further improving their cost-effectiveness. According to industry data, energy-efficient upgrades often return 70% to 90% of their cost at resale, making them some of the smartest long-term investments a homeowner can make.

Kitchen and bathroom renovations also tend to deliver high ROI, particularly when they modernize outdated spaces without over-improving for the neighborhood. A mid-range kitchen remodel—featuring new countertops, cabinets, and appliances—typically recovers over 70% of its cost. Similarly, updating bathrooms with water-efficient fixtures, improved lighting, and modern finishes can significantly enhance a home’s appeal. These rooms are heavily weighted in buyer evaluations, so even modest updates can make a noticeable difference.

Improving curb appeal is another low-cost, high-impact strategy. Simple landscaping, fresh paint on the front door, new house numbers, and well-maintained walkways create a strong first impression. Studies show that homes with enhanced exterior appeal sell faster and at higher prices than comparable properties with neglected exteriors. Adding a garage door or replacing an old one is another upgrade with exceptional ROI—often exceeding 90% in resale value.

In contrast, luxury additions like swimming pools, home theaters, or elaborate outdoor kitchens often fail to deliver proportional returns, especially in moderate-priced markets. These features may increase enjoyment for the current owner but don’t guarantee higher resale value and can even deter some buyers due to maintenance concerns. The key is to invest in improvements that broaden appeal rather than narrow it. By focusing on functional, market-aligned upgrades, homeowners can steadily increase their property’s worth and, by extension, their personal wealth.

Balancing Debt and Investment: The Bigger Financial Picture

While a mortgage can be a powerful tool for building wealth, it does not operate in isolation. A sound financial strategy requires balancing home debt with other critical priorities, including retirement savings, emergency funds, and diversified investments. Overemphasizing the mortgage at the expense of these areas can create vulnerabilities, even if home equity grows. The goal is not to eliminate the mortgage at all costs, but to integrate it into a holistic plan that supports long-term security and growth.

One common mistake is diverting too much capital toward mortgage prepayments while neglecting retirement accounts. Employer-sponsored plans like 401(k)s often include matching contributions—a form of free money that should not be left on the table. For many, maximizing retirement contributions up to the match should take precedence over extra mortgage payments. Similarly, maintaining a fully funded emergency fund—typically three to six months of living expenses—provides a financial buffer that prevents forced borrowing during unexpected setbacks. Without liquidity, even a well-managed mortgage can become a source of stress if job loss, medical issues, or repairs arise.

Diversification is another essential principle. While real estate is a valuable asset class, relying solely on home equity exposes a household to market-specific risks. Geographic downturns, local economic shifts, or neighborhood changes can affect property values. Spreading investments across stocks, bonds, and other vehicles helps mitigate this risk and provides opportunities for growth uncorrelated with housing markets. A balanced portfolio allows wealth to grow in multiple directions, reducing dependence on any single asset.

The optimal approach varies by individual circumstances. Younger homeowners with long time horizons may prioritize retirement investing over rapid mortgage payoff, while those closer to retirement might focus on reducing housing debt for greater peace of mind. The key is regular assessment—reviewing financial goals, income changes, and market conditions to adjust the strategy as needed. By viewing the mortgage as one component of a broader financial ecosystem, homeowners can avoid tunnel vision and build a more resilient, adaptable plan for lasting wealth.

Building Long-Term Wealth: Patience, Planning, and Perspective

Turning a mortgage into a wealth-building engine is not a quick fix or a speculative gamble. It is a deliberate, long-term strategy rooted in discipline, informed decisions, and a clear understanding of financial principles. The transformation happens gradually—through consistent payments, smart refinancing, strategic improvements, and balanced financial management. Over time, these choices compound, turning a significant monthly expense into a foundation of stability and growth. The journey requires patience, but the rewards are tangible: increased equity, reduced debt, and a stronger financial position for the future.

One of the most important aspects of this approach is perspective. Homeownership should not be seen as a shortcut to riches, but as a patient, reliable path to financial strength. Market fluctuations will occur, interest rates will rise and fall, and personal circumstances will evolve. What remains constant is the power of consistent action. By staying focused on long-term goals—rather than reacting to short-term noise—homeowners can navigate uncertainty with confidence. They learn to distinguish between emotional decisions and strategic ones, avoiding the pitfalls of fear-driven selling or impulsive borrowing.

Planning is equally vital. Setting clear financial goals, tracking progress, and adjusting strategies as life changes ensure that the mortgage remains aligned with broader objectives. Whether the goal is early retirement, funding education, or leaving a legacy, a well-managed home loan can play a central role in achieving it. The process also fosters financial literacy, empowering individuals to make informed choices across all areas of money management.

In the end, the story of transforming a mortgage into a wealth builder is not about complexity or risk. It’s about making intentional choices—small, smart decisions that add up over time. It’s about viewing ownership not as a burden, but as an opportunity. For millions of families, the home is the largest asset they will ever own. By managing it wisely, they can turn one of life’s greatest expenses into one of its greatest advantages. This is not magic. It’s strategy. And it’s within reach for anyone willing to plan, persist, and think long-term.