How We Smartly Picked Our Investments as a DINK Couple

As a DINK (Double Income, No Kids) couple, we had more financial freedom—but also more temptation to spend. We used to think, “We can always save later.” Then reality hit. With no kids to prioritize, the question became: How do we grow wealth without taking crazy risks? This is the exact journey we’re sharing—what worked, what didn’t, and how we finally built a portfolio that fits our life, goals, and peace of mind. It wasn’t about chasing stock tips or gambling on crypto. It was about creating a strategy grounded in patience, purpose, and practical choices. What started as scattered savings grew into a disciplined approach that brought us confidence, not just returns.

The DINK Financial Paradox: Freedom Without Focus

Having two incomes and no children often sounds like a financial dream. There are no tuition bills, no extracurricular fees, no college funds to stress over. Monthly cash flow feels generous, and there’s often a sense of comfort in knowing that bills are covered, vacations are affordable, and dining out is a regular pleasure. But this same comfort can quietly erode long-term financial discipline. Without the urgency that comes with raising children, many DINK couples fall into what financial planners call the “lifestyle drift”—a gradual increase in spending that matches income growth, leaving little room for meaningful savings or investments.

We were no exception. For years, we told ourselves we were “saving enough” because we had a growing bank balance and no debt. But when we looked closer, we realized most of that balance was earmarked for travel, home renovations, or simply held as a psychological safety net. We weren’t building wealth—we were preserving liquidity. The absence of a clear financial purpose made it easy to justify every expense. Why delay gratification when there’s no pressing long-term goal? This mindset, while emotionally satisfying in the short term, posed a real risk: we were financially free today, but potentially vulnerable tomorrow.

The turning point came when we projected our retirement needs. We realized that even with modest living expenses, our current savings rate would fall short by decades. The realization wasn’t about panic—it was about clarity. Our freedom wasn’t a flaw; it was an opportunity. But to use it wisely, we needed focus. We began by asking ourselves not just how much we could save, but why we were saving. Was it for early retirement? For a dream home? For the freedom to take career risks? These questions helped us shift from passive accumulation to intentional planning. Without children to define our priorities, we had to define them ourselves. That shift—from default spending to deliberate saving—was the first step in transforming our financial trajectory.

Redefining Our Financial Goals: What Matters Beyond Retirement

Retirement is a common financial goal, but for us, it felt too distant and abstract to drive daily decisions. We wanted to know what our money was working toward, not just when. So we redefined our goals in terms of lifestyle and flexibility. Instead of a single target date, we mapped out a series of milestones: traveling internationally every other year, upgrading our home within five years, and eventually launching a small side business. These weren’t fantasies—they were specific, time-bound objectives with estimated costs.

By assigning dollar amounts to these goals, we turned emotions into actionable plans. For example, we calculated that our biennial travel goal would require setting aside $8,000 annually. The home upgrade, factoring in inflation and contractor costs, needed a $75,000 fund over seven years. The business idea required a $50,000 launch budget, which we planned to build over a decade. Each of these goals then informed our investment strategy. Short-term goals (1–3 years) went into low-volatility vehicles like high-yield savings accounts and short-term CDs. Mid-term goals (4–7 years) were allocated to balanced mutual funds and conservative ETFs. Long-term goals (8+ years) were invested in growth-oriented index funds with higher equity exposure.

This goal-based approach changed our relationship with money. Instead of seeing investments as abstract numbers on a screen, we began to view them as progress markers. Watching our travel fund grow wasn’t just about returns—it was about counting down to our next adventure. This emotional connection made it easier to resist impulse purchases. When we considered a spontaneous luxury purchase, we’d ask: Is this worth delaying our home upgrade by six months? More often than not, the answer was no. By anchoring our financial decisions to tangible outcomes, we created a self-reinforcing cycle of discipline and motivation. The result wasn’t just better savings—it was greater satisfaction in how we used our money.

Risk Tolerance Isn’t Just a Questionnaire—It’s Real Life

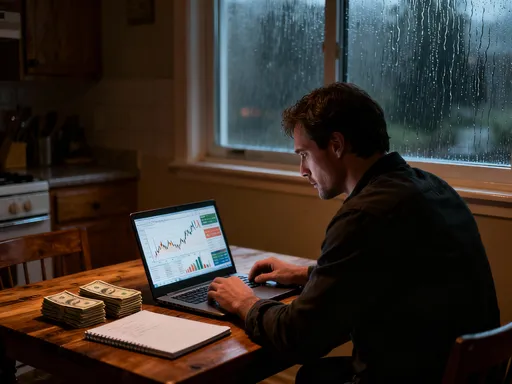

Early in our journey, we took a standard risk tolerance quiz offered by our brokerage. The results labeled us as “aggressive” investors—ideal candidates for high-growth stocks and emerging markets. Encouraged by this, we shifted a large portion of our portfolio into tech-heavy ETFs and individual growth stocks. For a while, it worked. Our account balance climbed steadily, reinforcing our confidence. But then the market corrected. Over a three-month period, our portfolio dropped by nearly 22%. What the quiz didn’t capture was how we’d actually feel watching that decline in real time.

Those months were stressful. We found ourselves checking our accounts multiple times a day, second-guessing our strategy, and losing sleep. We realized that our theoretical risk tolerance didn’t match our emotional resilience. The quiz had measured our willingness to take risk in a hypothetical scenario, but it couldn’t simulate the anxiety of seeing hard-earned money disappear. This experience taught us a crucial lesson: risk tolerance isn’t a static score—it’s a dynamic response shaped by market conditions, life circumstances, and personal psychology.

We responded by rebalancing our portfolio to better reflect our true comfort level. We reduced our allocation to high-volatility equities and increased our holdings in dividend-paying stocks and investment-grade bonds. We also introduced a “risk buffer” of cash equivalents equal to one year’s worth of living expenses outside of retirement accounts. This gave us psychological breathing room. Even if the market dropped again, we knew we wouldn’t need to sell investments at a loss to cover essentials. Over time, this more balanced approach delivered slightly lower returns—but far greater peace of mind. We learned that sustainable investing isn’t about maximizing gains; it’s about staying the course. And staying the course requires a strategy that aligns with both our financial goals and our emotional reality.

Building a Core Portfolio: The Foundation That Works for Us

With our goals and risk tolerance clarified, we focused on building a core portfolio that was simple, diversified, and easy to maintain. We didn’t want to spend hours analyzing stocks or timing the market. Instead, we prioritized reliability and consistency. Our foundation consists of three main components: low-cost index funds, balanced mutual funds, and a strategic bond allocation. Each was chosen not for its potential to outperform, but for its ability to perform steadily over time.

Our equity exposure is primarily in broad-market index funds, such as those tracking the S&P 500 and total international markets. These funds offer instant diversification across hundreds of companies, reducing the impact of any single stock’s performance. Their low expense ratios mean more of our returns stay in our pocket. We contribute to these funds monthly, regardless of market conditions, embracing dollar-cost averaging as a way to smooth out volatility. For fixed income, we use a mix of intermediate-term bond funds and Treasury Inflation-Protected Securities (TIPS). These provide steady income and act as a stabilizer during market downturns. Our bond allocation is kept at a level that matches our risk profile—high enough to reduce volatility, but not so high that it drags down long-term growth.

The third pillar of our core is a balanced mutual fund—a professionally managed mix of stocks and bonds designed to maintain a consistent risk level. This fund serves as a “set-and-forget” option for a portion of our savings, particularly in accounts where we don’t want to actively manage allocations. Together, these three components form a resilient base that requires minimal maintenance. We review them quarterly, but we don’t react to short-term noise. This core portfolio now makes up about 80% of our total investments. It’s not flashy, and it won’t make headlines. But it’s reliable, transparent, and aligned with our long-term vision. In a world full of financial complexity, simplicity has become our greatest advantage.

The Role of Alternative Assets: When to Step Beyond the Basics

Once our core portfolio was stable, we cautiously explored alternative assets to enhance diversification and long-term returns. We didn’t jump in blindly—we started small and focused on options with clear fundamentals. The first addition was real estate investment trusts (REITs), which allow us to gain exposure to commercial and residential properties without the burden of direct ownership. We allocated 7% of our portfolio to publicly traded REITs, focusing on those with strong balance sheets and consistent dividend payouts. These have provided both income and inflation protection, performing well during periods when traditional stocks struggled.

Next, we introduced a small allocation to dividend growth stocks—companies with a history of increasing their payouts annually. These aren’t speculative picks; we selected established firms in sectors like consumer staples, utilities, and healthcare. These stocks offer a dual benefit: they generate passive income and have historically shown resilience during market corrections. We limit this category to 8% of our portfolio, ensuring it doesn’t skew our overall risk profile. We also explored a private equity opportunity through a small-scale, accredited investor fund focused on early-stage healthcare companies. This is our highest-risk holding, capped at 3% of our total investments. We only participated after thorough due diligence, including reviewing the fund’s track record, management team, and investment thesis.

The key to our approach with alternatives is intentionality. Each addition serves a specific purpose: REITs for real estate exposure, dividend stocks for income and stability, private equity for long-term growth potential. We avoid trendy assets like cryptocurrencies or meme stocks because they don’t align with our values of transparency and sustainability. Our rule of thumb is simple: if we can’t explain an investment’s value in plain language, we don’t buy it. Alternatives aren’t about chasing returns—they’re about filling gaps in our core strategy. By keeping allocations small and well-reasoned, we’ve added modest upside without compromising our overall stability.

Automating Discipline: How Systems Beat Willpower

One of the biggest challenges we faced wasn’t picking the right investments—it was staying consistent. Life gets busy. Vacations happen. Unexpected expenses arise. In the early days, we’d sometimes skip contributions or delay rebalancing because we were focused on other priorities. We realized that relying on willpower alone wasn’t sustainable. What we needed was a system that removed the need for constant decision-making.

So we automated everything. We set up direct deposits from our paychecks into our investment accounts, ensuring that a fixed percentage was invested before we even saw the money. We programmed monthly transfers to our goal-specific accounts—travel, home, business—so each objective received consistent funding. We also enabled automatic rebalancing on our brokerage platform, which adjusts our asset allocation back to target levels twice a year. These systems operate in the background, requiring no daily oversight.

The impact has been profound. Automation eliminated the mental load of “remembering” to invest. It also removed the temptation to time the market or pause contributions during downturns. Even when we were on vacation or dealing with a stressful month, our investments kept growing. We also adopted behavioral design tactics, such as naming our accounts with clear labels (“Europe Trip 2026,” “Kitchen Remodel Fund”) to reinforce their purpose. We found that seeing these names during transfers made us less likely to redirect the money. Discipline, we learned, isn’t about self-denial—it’s about creating structures that make the right choices effortless. By designing our financial life around automation, we turned good intentions into lasting habits.

Reviewing and Adapting: The Ongoing Conversation We Have

Our financial plan isn’t set in stone. Every six months, we schedule a dedicated review session to assess our progress. We look at portfolio performance, but we don’t obsess over quarterly returns. Instead, we focus on whether our strategy is still aligned with our goals and life circumstances. Has anything changed? Are we on track? Do we need to adjust our savings rate, reallocate assets, or revise a timeline?

These reviews have led to several thoughtful adjustments. When we decided to delay our home renovation by a year, we redirected those monthly contributions into our long-term growth fund. When one of us took a pay cut to pursue a passion project, we temporarily reduced our investment rate and relied more on our emergency fund. When interest rates rose, we shifted some cash into higher-yielding CDs without abandoning our core strategy. Each change was deliberate, not reactive. We avoid making emotional decisions based on market headlines or short-term fluctuations.

This ongoing dialogue keeps our financial plan alive and responsive. It’s not a rigid blueprint—it’s a living framework that evolves with us. We’ve learned that flexibility is not the enemy of discipline; it’s a necessary part of it. Life is unpredictable, and a good financial strategy must be able to adapt. By building in regular check-ins, we ensure that our investments remain aligned with who we are and where we want to go. This practice has deepened our partnership, too. Discussing money isn’t a source of conflict—it’s a shared commitment to building the life we envision together.

Conclusion: Investing as a Reflection of Values, Not Just Numbers

For DINK couples, financial choices are deeply personal. Without the traditional milestones of parenthood, we have the freedom—and the responsibility—to define what wealth means to us. Our journey taught us that successful investing isn’t about picking the hottest fund or achieving the highest returns. It’s about creating a strategy that reflects our values, supports our goals, and allows us to sleep well at night. We’ve learned that clarity beats complexity, consistency beats timing, and peace of mind is worth more than any short-term gain.

What started as a need to grow our savings became a process of financial self-discovery. We’re not just building a portfolio—we’re building a future. One that includes travel, home, creativity, and security. We’ve made mistakes, adjusted course, and grown more confident with each decision. The freedom of being a DINK couple is real, but it’s only valuable if it’s sustainable. By focusing on purpose, discipline, and adaptability, we’ve turned financial freedom into lasting security. This journey wasn’t just about growing money. It was about growing up—financially.