How I Smarten Up My Cultural Spending Without Sacrificing Joy

What if enjoying art, music, or travel didn’t have to drain your wallet? I used to think cultural consumption was just another expense—until I learned to treat it like an investment in myself. By applying simple financial skills, I’ve doubled my experiences without doubling my budget. Curious how? Let’s break down the real moves that helped me spend smarter, protect my cash, and still live richly. It’s not about cutting back on what brings joy; it’s about making every dollar work harder so that joy becomes sustainable. This journey isn’t about deprivation—it’s about clarity, intention, and strategy. And the best part? You don’t need a six-figure income to make it work. With the right mindset and tools, anyone can enjoy a full cultural life without financial stress.

The Mindset Shift: From Spending to Strategic Enjoyment

For many, cultural spending feels like a luxury that must be justified. Buying concert tickets, visiting museums, or booking a weekend trip often comes with a whisper of guilt: “Is this really necessary?” That internal dialogue can lead to either overspending in moments of indulgence or complete avoidance out of fear. But what if we reframed cultural consumption not as an expense, but as a meaningful investment in personal well-being and growth? This shift—from seeing spending as passive to viewing it as strategic—is the foundation of smarter financial behavior.

Smart cultural spending means intentionally allocating resources to experiences that enrich your life, rather than reacting to impulse or social pressure. It’s not about eliminating joy, but about aligning it with your values and financial reality. Traditional budgeting often fails in this area because it treats all discretionary spending the same, lumping movie tickets with fast food or online shopping. But culture nourishes the mind and spirit in ways few other expenses do. When you recognize this, you begin to see budgeting not as a restriction, but as a tool for prioritization.

Value-based allocation is the key. Instead of asking, “Can I afford this?” ask, “Is this worth it to me?” This subtle change transforms decision-making. For example, skipping a trendy brunch spot to save $25 might feel like a loss, but redirecting that money toward a live theater performance you’ve been wanting to see suddenly feels like a gain. The amount is the same, but the emotional and personal value differs significantly. By defining what truly matters—whether it’s live music, art exhibitions, or travel—you create a framework that guides spending with purpose.

Moreover, this mindset helps prevent the cycle of guilt and overcorrection. Many people fall into the trap of overspending on cultural events during periods of emotional need, then punishing themselves with extreme cutbacks afterward. This rollercoaster is exhausting and unsustainable. A strategic approach, on the other hand, builds consistency. When you plan for cultural experiences as part of your lifestyle—not exceptions to it—you reduce the emotional weight of each decision. The result? More joy, less stress, and greater financial control.

Mapping Your Cultural Budget: Where Does the Money Really Go?

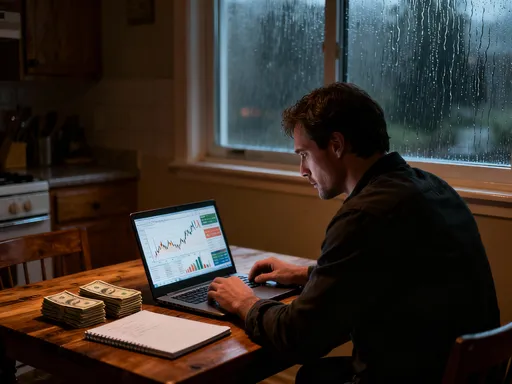

The first step in gaining control is awareness. Most people have a general sense of their spending, but few track the specifics of their cultural consumption. How much do you really spend on streaming services, concert tickets, books, or museum entries each month? Without clear data, it’s easy to underestimate these costs. A $15 concert ticket here, a $12 audiobook there, a $9 museum admission—these small amounts can quietly accumulate into hundreds per year. And when travel is included, the numbers can climb even faster.

Take the case of Sarah, a 42-year-old teacher who considered herself frugal. She was surprised to discover, after reviewing three months of bank statements, that she spent an average of $180 per month on cultural activities—$60 on streaming platforms, $45 on books and audiobooks, $35 on local events, and $40 on museum and gallery visits. That’s $2,160 a year—more than her annual car insurance. Yet, she rarely felt she was overspending because each individual purchase felt minor. This is a common pattern: small, frequent transactions create a false sense of affordability while adding up to significant outflows.

Tracking your spending reveals these leaks. Start by gathering all financial records—bank statements, credit card bills, digital wallets—and categorize every cultural expense. Be thorough: include digital subscriptions, ticket fees, parking costs for events, and even small donations to arts organizations. Once you have the data, group them into categories: entertainment (concerts, films, theater), learning (books, online courses, workshops), and travel (cultural trips, city explorations). This breakdown makes it easier to see where your money flows and where adjustments might be needed.

Next, compare your actual spending to your ideal budget. Ask yourself: Does this allocation reflect what I truly value? If you love live music but rarely go to the theater, why are you paying for a streaming service heavy on plays? If you read only one book a month, is an unlimited audiobook subscription really worth $15? These questions help distinguish needs from wants, not in a restrictive sense, but in a clarifying one. The goal isn’t to cut everything—you might decide to keep a high-cost subscription because it brings daily joy—but to make decisions consciously, not habitually. Awareness is power, and in personal finance, it’s the first step toward control.

The Art of Timing: When to Buy, When to Wait

Timing is one of the most powerful yet underused tools in smart cultural spending. Many people pay full price for tickets, books, or travel simply because they don’t know when to act—or when to hold back. But a little patience and planning can lead to substantial savings. For example, booking a concert ticket six weeks in advance can save 30% compared to last-minute purchases. Similarly, buying museum passes during off-peak seasons or waiting for annual sales on streaming bundles can drastically reduce costs without diminishing the experience.

Early-bird pricing is a common strategy in the cultural sector. Event organizers often release a limited number of discounted tickets to generate buzz and ensure early revenue. These deals can apply to music festivals, theater performances, and even educational workshops. By planning ahead and setting calendar alerts for ticket releases, you position yourself to access these lower prices. This requires a shift from reactive to proactive behavior—instead of waiting until the weekend to decide what to do, you plan your cultural calendar months in advance, just as you would a major purchase.

Travel offers some of the most dramatic timing benefits. A trip to a major cultural city like Chicago, Boston, or Denver can cost hundreds more during peak tourist seasons. But traveling in the shoulder months—just after summer or before spring break—can reduce accommodation costs by 25% to 40%, while still offering full access to museums, performances, and local events. Many cultural institutions even offer special off-season programming, meaning you might get a richer experience at a lower price. The key is flexibility. If your schedule allows, shifting your plans by a few weeks can unlock significant value.

Subscription cycles also matter. Rather than signing up for a service on the spot, consider waiting for promotional periods. Many streaming platforms offer free trials or discounted first-year rates. Libraries often provide free access to premium content through partnerships, allowing you to enjoy books, films, and music without paying a dime. By aligning your purchases with natural pricing cycles, you gain more for less. This doesn’t require complex financial knowledge—just awareness and discipline. The reward? More experiences, less financial strain.

Leveraging Memberships, Subscriptions, and Passes

Subscriptions and memberships can be powerful tools—or silent budget killers. The difference lies in usage. A $60 annual museum membership is a great deal if you visit six times a year; it’s a waste if you go once. The same applies to streaming bundles, loyalty programs, and city cultural passes. The key is not whether the service exists, but whether it fits your actual behavior. Emotional decisions—like signing up for a music service because a friend recommended it—often lead to unused subscriptions that quietly drain your account.

To evaluate a membership or pass, use a simple cost-per-use calculation. Divide the annual fee by the number of times you expect to use it. If a city cultural pass costs $120 and grants access to ten venues, you break even at 12 visits per year. But if you realistically plan to visit only four times, you’re overpaying. Conversely, if you love art and attend multiple exhibitions annually, the pass might save you $200 in individual ticket fees. The goal is to match the financial commitment to your lifestyle, not the other way around.

Some programs offer hidden advantages beyond entry. Museum memberships often include reciprocal benefits at other institutions, guest passes, or discounts on events and cafes. Library cards provide free access to digital magazines, streaming platforms, and even museum tickets through local partnerships. Employer-sponsored benefits, such as tuition reimbursement or cultural stipends, can also offset costs. These extras increase the value of your investment without increasing your spending.

When considering a new subscription, impose a 30-day waiting period. Use that time to research alternatives, check for free trials, and assess your current usage. Ask: Do I already have access through another source? Can I borrow or share with a family member? Is this solving a real need or just a fleeting interest? This pause helps prevent emotional sign-ups and ensures that every recurring charge earns its place in your budget. Over time, this disciplined approach builds a lean, high-value set of cultural tools that support your life without burdening it.

Maximizing Value: Experience Stacking and Hidden Perks

Smart cultural spending isn’t just about cutting costs—it’s about increasing value. One of the most effective strategies is experience stacking: combining low-cost or free activities with paid ones to create richer, more fulfilling outings. For example, instead of spending $70 on dinner and a concert, pack a picnic and arrive early to enjoy the outdoor space before the show. You’ve reduced food costs, added a pleasant pre-event experience, and maintained the joy of live music.

Communities often offer free cultural events—outdoor concerts, art walks, film screenings in the park—that can be paired with small paid elements to enhance the day. A $5 coffee from a local café, a $12 gallery entry, or a $10 souvenir can turn a free evening into a memorable experience. The key is intentionality: plan these combinations in advance so they feel curated, not cheap. This approach allows you to enjoy variety without overspending.

Public libraries are one of the most underused resources in cultural finance. Beyond books, many offer free access to streaming services like Kanopy or Hoopla, which include films, documentaries, and music. Some provide free museum passes that can be reserved online—no cost, no hassle. Others host author talks, workshops, and cultural lectures. These services deliver high-value experiences at zero financial cost, making them essential tools for the budget-conscious culture lover.

Employer and community benefits also play a role. Some companies offer cultural reimbursement programs or partner with local arts organizations to provide discounted tickets. Community centers and religious organizations often host low-cost events or group outings. Even credit card rewards can be used strategically—points redeemed for event tickets or travel reduce out-of-pocket costs. By layering these resources, you create a web of access that multiplies your options without increasing your spending. This is financial intelligence in action: using what’s already available to live more fully.

Risk Control: Avoiding the Emotional Spending Trap

One of the biggest challenges in cultural spending is emotional decision-making. The fear of missing out (FOMO), social pressure, or the excitement of a limited-time offer can override rational judgment. You see a last-minute concert ticket ad, think, “This might be my only chance,” and click “buy” before considering the cost. These impulses are normal, but they can lead to regret and financial strain if left unchecked.

Behavioral finance shows that people are more likely to overspend when decisions are tied to emotion. Cultural events, by their nature, evoke strong feelings—anticipation, nostalgia, inspiration. Marketers know this and design promotions to trigger quick action. Phrases like “Only 3 tickets left!” or “Offer ends tonight!” create urgency that bypasses careful thinking. The solution is not to suppress emotion, but to build systems that allow it to coexist with financial discipline.

Pre-commitment rules are effective. For example, set a personal policy: no cultural purchase over $50 without a 48-hour waiting period. During that time, review your budget, check for alternatives, and assess whether the event aligns with your values. You’ll find that many “must-have” experiences lose their urgency after a day or two. This cooling-off period doesn’t eliminate joy—it ensures that joy is built on a foundation of stability.

Another tool is the “joy-to-cost” ratio. Before buying, ask: How much lasting happiness will this bring relative to its cost? A $200 weekend trip that creates lasting memories may be worth more than five $40 impulse buys that fade quickly. This isn’t about denying pleasure, but about investing in experiences that deliver long-term value. Over time, this habit leads to more thoughtful choices and fewer regrets. Financial health isn’t measured by how little you spend, but by how well your spending reflects your true priorities.

Building a Sustainable Habit: Long-Term Financial Balance

The ultimate goal of smart cultural spending is sustainability. It’s not about squeezing every penny or denying yourself joy—it’s about creating a lifestyle where enrichment and financial health coexist. This requires balance: enjoying the present while preparing for the future. A well-planned cultural budget doesn’t compete with savings goals; it complements them. When you spend with intention, you reduce financial stress, which in turn supports long-term well-being.

As income changes, so should your habits. A raise or bonus doesn’t mean automatic increases in spending—it means an opportunity to reassess. You might choose to allocate more to cultural experiences, or you might decide to save the extra income. The key is conscious choice, not automatic escalation. Lifestyle inflation—spending more just because you earn more—can erode financial progress. By maintaining discipline, you protect your gains and ensure that joy remains affordable over time.

Success isn’t measured by how many events you attend or how much you spend, but by how well your spending aligns with your values. Do you feel fulfilled? Are your experiences meaningful? Is your financial life stable? These are the real indicators. When you can answer yes, you’ve achieved true financial skill. It’s not about austerity or excess—it’s about harmony.

Living richly doesn’t require a rich budget. It requires a rich mindset. By treating cultural spending as an investment, tracking your habits, timing your purchases, leveraging resources, and managing emotional impulses, you create a life of depth and joy without financial strain. The most valuable currency isn’t money—it’s time, attention, and intention. Spend them wisely, and you’ll find that the richest experiences cost far less than you think.